Notion Trading Plan

Without a trading plan, you will most likely break your rules. It is also difficult to track your performance or areas of mistakes. That is why this Notion Trading Plan Template comes in handy.

Every trader should have a solid trading plan irrespective of their trading style or capital invested. While you can create a trading plan in a notebook or Excel sheets, it is more useful and easier to organize, possibilities are endless, and it is usually the best option for quick reference if you do it on Notion.

So, here, I will share how to create your own overall trading plan and strategy plan in Notion. But if you want quicker results, are busy, or are just lazy, you can also try my Detailed Notion Trading Plan Templates and Complete Notion Trading Dashboard Template.

Notion Basics

Create Pages

First, create a dedicated page for the Trading plan on Notion.

You can check this blog post if you are new to Notion and don’t know how to use it.

You can create separate pages for the overall plan, trading strategy, etc. If you trade on different assets, it is better to have different strategies and corresponding plans.

Create blocks

Next, create blocks according to your preference. Some people may prefer simple checklists; some may use plain text notes or a more detailed but little complex database. Some may even use a combination of all these blocks.

I prefer a combination of blocks to other blocks as it helps me track each and every detail of my trade, and it is easier for quick reference and organization.

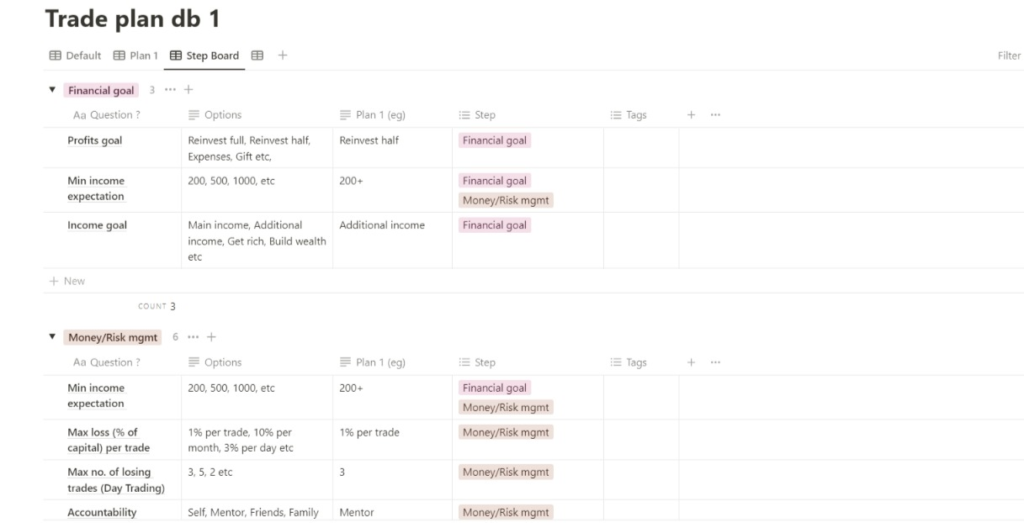

So, let’s now create a simple database in the overall trading plan.

Overall trading plan

Here, the overall trading plan includes all the assets, strategies, and their plans. It is better to have a separate trading strategy for each asset and market condition. 2-3 is usually preferred.

What to plan?

There are so many things to plan, but these are the basic things every trader should plan.

I have organized things to plan according to my 10-step trading plan for better organization.

Feel free to add or remove any of the properties to keep it according to your style.

Income goal

First, start with the income goal of your trading. Why do you want to trade?

Do you want to create an additional source of income?

Do you want this to be your main income source?

Do you want to get rich by trading?

Or just want to grow your wealth?

Planning the income goal is important because you should track whether you are on the right track every time you trade, and also because you might need to tweak your strategy according to your goals.

If this is to grow your wealth, you don’t have to trade every day. You can just invest your money in carefully selected multi-bagger stocks and go on with your life.

If you want an additional source of income, you can safely do swing trading and focus on your main source of income.

But if this is your main source of income, you should be very careful with your money and emotions and do a very calculated trade every time.

Profit goal

Next will be your profit goal. What do you want to do with your profits?

Do you want to use it for your expenses?

Do you want to reinvest the full profit to grow your wealth? You can do this if you don’t need this profit for your expenses. Or do you want to reinvest half of the profit and use the other half for expenses?

Or do you want to gift it to your family or friends?

Make sure you track everything, especially if you are reinvesting your profit to make sure you do it right. You might use a Notion calculator database for this purpose, which I will be posting shortly.

Minimum income expectations

Next, set your minimum income expectations, in numbers. It has to be a minimum value because you should not pressurize yourself to earn more, as the market is unpredictable.

You can expect 2-5% of your capital if you are a beginner.

So if you invest $10,000, you can write $200 as minimum profit, providing you keep the maximum $100 as your stop loss.

Initial trading capital

Next, you should plan your money management rules.

First, decide how much you are going to invest in trading.

If you are diversifying, how much for each strategy or asset? Whether it is a small account, a medium account, or a large account.

E.g., 1000, 10000, etc.

Max loss

The main part of your money management is your risk management.

Planning and sticking to how much you are willing to lose will preserve your capital.

So plan how much of the capital you are willing to lose e.g., 1% of the capital per trade for day trades, 10% of the capital per month, etc.

You can also create your own rules and write them out here.

Losing trades

This one is useful for day traders or scalpers. It is mandatory to choose the number of losing trades before you stop trading for the day, e.g., 3 consecutive losses per day.

Accountability

Though it doesn’t come under the common money management plan, it is advisable to have some kind of accountability so that you don’t go all in with your emotions.

This method will prevent you from losing your entire capital.

E.g., You can inform your friends or family to track the trades and stop you when you lose x amount of money. Having a mentor always helps.

Risk-reward

The main part of risk management is planning your risk reward ratio.

For example, if your risk-reward ratio is 1:2, your profit level should always be twice the stop loss level.

If it is 1:4, profit = 4*stop loss. You get the point.

So plan the ratio according to your strategy and stick to it.

This is one of the main rules that will keep you profitable overall.

Opportunities

While planning your strategy, you should always look for a SWOT analysis. Make note of all your opportunities, threats, strengths, and weaknesses.

If you have been tracking the market for a long time, you will likely know what are the opportunities present and when you can make use of them.

For example, news like earnings release can create an opportunity for swing and option buyers, global market fall can create an opportunity for option traders, etc.

You can also make use of seasonal stocks, high momentum stocks.

Though these can be used by all kinds of traders, if something is suitable for you based on your preference and capital, you can plan and watch out for these cues.

Threats

Threats can be the opposite of opportunities. i.e., if you are a call option seller, earning release can be a threat to you if the result is positive. So note it down on your planner and always keep an eye out for your threats.

Weaknesses

Weaknesses can be from the strategy as well as your emotions.

Note down the cons of your strategy. e.g., doesn’t work in a bearish market, etc.

The most important thing is to note down your weaknesses like your personality traits or situations which can prevent you from being at your best while trading. e.g., Easily stressed, no patience, no free time, etc.

This will eventually help you come up with solutions for your problems.

Strengths

Strengths can be based on the strategy and your personality. E.g., Strategy works in a range-bound market, I am emotionally resilient and have a high level of patience.

Noting this down in your planner will help you remind yourself of your strengths when you lose your hope, and you will always strive to maintain and improve your strengths.

Asset

Note down the asset you are trading for that particular strategy. You can create multiple plans for each asset. But try to keep it a minimum of 1 -3. Assets can be stocks, cryptocurrencies, commodities, currencies, derivatives like futures and options, etc.

Strategy name

Create a name for your strategy so that it will be easier for you to link and refer back to it in the future.

A name can contain anything you want.

For example, I would name my strategy like indications+style of trading. e.g., Price action day trading, MACD swing trading, etc.

You can also add assets but keep it short. stock price day trading, options MACD swing trading.

Strategy

Here, write whether you are using indicators, price action, or both. You can also quickly enter your criteria like stock selection, entry, and exit criteria. E.g., 20-50 ema cross. It means that this is your criteria for your stock selection, entry, stop loss, and target.

Style of trading

Note down your style of trading. Whether it is day trading, scalping, swing, or positional trading.

Analysis & Review

Plan what, when, and where you will do your pre-trade analysis and post-trade reviews. You can mention whether you will do it weekly, monthly, or daily, what factors you will analyze and review and create a link to your analysis and review pages.

Time to spend

Plan how much time you will spend for trading. It depends upon your style of trading. e.g., 1 hour per day, 1 hour per week, etc.

Manage emotions

When it comes to emotional management, you should be very careful and strict as it is the single most factor that will keep you in the market for a long time.

Write down how you will manage your emotions during trading. e.g., Meditation, breathing, workouts, journaling, etc. This is very important, and you should practice this regularly to avoid emotional trades.

Motivation

Decide how you will motivate yourself when you are on a losing streak. e.g., affirmations, success tips from experts, etc. This period is inevitable and you will need it someday.

Links

Here, link all the links needed for trading like links of the trading strategy, backtesting, paper trades, journal, etc. The text property in Notion allows you to place multiple links.

Journal mode

Write down how you are going to journal your trades. e.g., offline, online, specific apps like Notion, docs, Evernote, etc.

Journal method

Also, write down what you will journal. Whether you are going to note down all the details, tweak the automated journal, or just take screenshots or videos.

Notes

You can write everything else in notes.

Planning and sticking to these things will keep you profitable in the market for a long time.

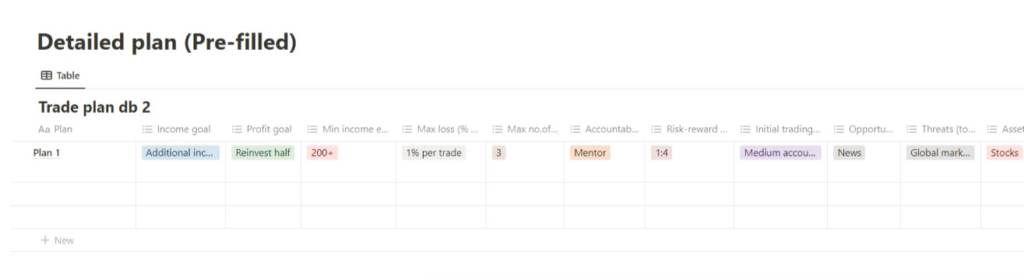

Pre-filled plan

In my template, this database is pre-filled in each property and you can easily select between options. This comes in handy if you don’t want a detailed trading plan like the first one.

Just write the strategy name in the name property and choose your options. You can create multiple strategies this way in a few minutes.

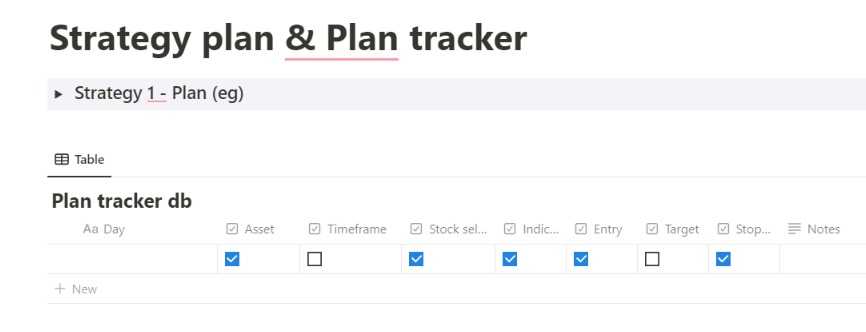

Strategy plan & Plan tracker

The above-mentioned plan is the overall plan. The most common one found on the internet is the strategy plan. You will find the strategy plan here. And you can also find the tracker here.

Strategy Plan

In a strategy plan, you should breakdown your strategy into a detailed strategy so that you will be clear when you take a trade and will know where you are going wrong. These are few of the things you can plan for your strategy…

Asset – Mention the type of asset like stocks, crypto, options, etc. E.g., Stocks

Timeframe – Timeframes used for that particular strategy like 1 day, 5 mins, etc.

Stock selection criteria – What is the criteria for your stock selection. If you are trading in index options and futures or any other single instrument, just mention the instrument name. E.g., Breakout & Pullback, Banknifty options, etc.

Indicators / Price action – What are the indications you are going to consider as an indication for your stock selection or entry. E.g., Both.

Holding type – How long you are going to hold your trades like day, scalp, swing, etc.

Entry criteria – What is the criteria for your entry based on indicators or price action. e.g., Pullback, Bullish candle, MACD, etc.

Stop loss criteria – What is the criteria for stop loss? e.g., 1 ATR

Target criteria – What is the criteria for your target? e.g., 2 ATR

Links – You can include all links to the pages here with mentions e.g., Backtesting & Paper trade links, etc

Pros – What are the pros of the strategy? e.g., Increased probability of success

Cons – What are the cons of the strategy? e.g., Hard to find stocks

Notes – You can write other points here as notes

Pics – If there are any pictures to be attached, you can create a page for that and include all the images required for the strategy like past trades, backtest results, etc.

Plan tracker

This tracker comes with basic things to track every time you trade.

This is to make sure you follow your plan and find out your mistakes.

You can also integrate this page with your trading journal by using a relational database or just by creating a backlink to the page. Planning factors like strategy, emotions, risk reward, etc., can be tracked.

You can create a checklist for each property and name the thing you want to track. You can also add dates, add or remove other properties.

Just check off the rule property every time you follow the rule. E.g., On a particular day, you have followed the exact strategy, but your emotions can’t be managed, but still you are in profits.

Now you should check off the strategy property but not the emotions property. Leave it unchecked. Later when you refer to it you will understand how certain things affected you. You might also find out that if you were emotionally strong you would have been much more profitable.

About Post Author