A trading plan is a set of guidelines that traders use to make decisions about what to buy or sell and when.

A trading plan can be used for any type of investment or trading strategy from short-term day trading on the stock market to long-term investing in the stock market.

What is a trading plan?

A trading plan is a strategy that helps you in determining which trades to execute and when.

A good trading strategy should incorporate market conditions, technical analysis, fundamental analysis, and personal preferences.

Benefits

1. Trading plans are great tools for beginners and experienced traders alike. They help you learn how to trade and they teach you what to look for in order to improve your results. When you follow a trading plan, you’ll save time and energy, because you won’t waste precious hours doing things that you already know.

2. Trading plans are designed to give you a step-by-step guide to success. This means that you won’t have to spend hours trying to figure out what to do next, and you’ll always know where you stand.

3. A trading plan helps you stay focused. By following a clear strategy, you’ll never be distracted by random thoughts or emotions. You’ll be able to focus solely on the task at hand.

4. Trading plans allow you to track your progress. Once you’ve developed a plan, you’ll want to monitor its effectiveness. You’ll know whether your trades are working well or not, and you’ll be able to adjust accordingly.

5. A trading plan gives you direction. As you develop your skills and gain experience, you may feel lost without some sort of goal. Using a trading plan allows you to move forward in a structured manner.

How do you create a trading plan?

A trading plan should include entry and exit criteria, strategy rules as well as money management rules.

These three elements are different for every trader based on their risk tolerance level and objectives.

Entry criteria

An entry point is the price, quantity, or other parameter that you set to buy or sell a given asset.

The entry point can be any 1 of the following:

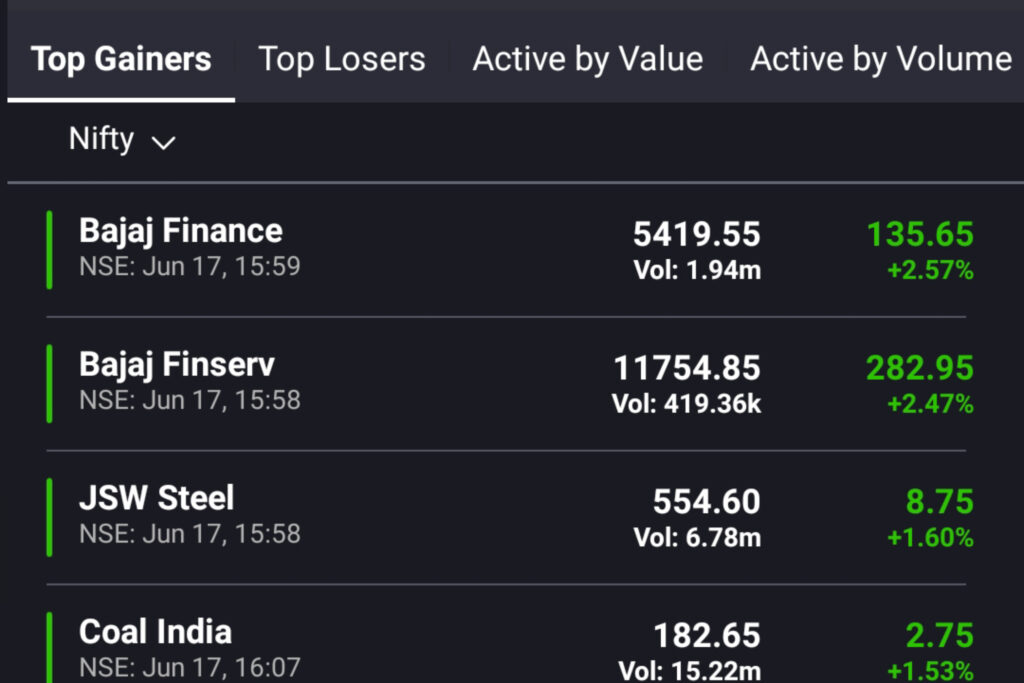

Top gainers or losers,

Option chain analysis,

The offer price on a stock,

The opening price of a tradeable asset,

Indicators based signals like moving averages, rsi, macd etc.

Price action signals like price breakout, volume breakout etc.

News based entry etc.

Exit criteria

Once you have entered the position and bought shares at your entry point, you can then select your exit point.

In general, the exit point is a level or price at which you will sell your position.

It can be any 1 of the following:

Risk reward ratio based,

Indicator or price action exit signals,

Trailing stop loss,

Fixed target and stop loss per day.

Money management rules

The risk management rules dictate how and when to close a trade given certain market conditions such as

Capital per trade

Risk per trade

Max profit per day

Max loss per day

Quantity etc.

Example Questions

When developing a trading plan, keep the following basic questions in mind:

1. Money management rules

How much capital am I willing to put at risk per trade?

Eg. 10000$

Should I try to limit my losses or maximise my profits?

Eg. Limit my loss

How many trades will I take per day?

Eg. 1 or 2 trades per day

What will be the max loss per day, after which I will stop trading ?

Eg. 100$

What will be the maximum profit per day, after which I will stop trading ?

Eg. 400$

What will be the quantity?

Eg. 0.01 lot size

2. Strategy rules

Will I use stop-loss orders or let my position run until I am satisfied with the results?

Eg. Let my positions run

Will I follow the trend or wait for confirmation signals?

Eg. Follow the trend

Will I use a breakout strategy or will I enter at l reversals ?

Eg. Breakouts

Will I use a scalping strategy or will I hold positions overnight?

Eg. Day trading

Will I trade both long and short or only buy?

Eg. Only buy

3. Entry criteria

Where is my entry point?

Eg. When 20 Ema crosses above 200 Ema.

4. Exit criteria

Where is my target ?

When 20 Ema crosses below 200 Ema.

Where is my stop loss ?

Eg. Previous swing low.

Examples of a trading plan

A trading plan can be created in a variety of ways including longer form, shorter form, tables, mind maps, checklists etc.

Now, As per the examples mentioned above, any 1 of this would be my trading plan template:

Example 1 (Long version)

My trading capital is $10,000, and my ultimate goal is to limit my losses by having a fixed number of losses per day of $100, and a profit per day of $400, with a risk-reward ratio of 1:4.

I will only trade long positions and exit them on the same day. I’ll trade trends after breakouts and let my positions run.

When the 20 ema crosses above the 200 ema, I will enter and exit with a stop loss below the previous swing low.

Example 2 (Short version)

Money- 10k capital, 1:4 RRR.

Strategy – long only, day trade, breakouts, profits run.

Entry – 20 Ema crosses above 200 Ema.

Exit – 20 Ema crosses below 200 Ema / previous swing low.

My experience

For two years, I didn’t have a trading plan. Later on, I created a trading plan for money management.

My trading plan varies depending on the market.

My trading plan now looks like this:

200 ema for trend direction

Previous day High or Low / Range breakout and retest

1:1.5+ Risk reward ratio

Fixed capital per trade

1% Risk per trade

1 trade per trade etc.

Where to learn all about trading plan?

The above mentioned one is just MY trading plan. However, you can feel free to check out other ways of doing it in the following videos.

Takeaways

- Trading plan is a set of rules and guidelines to make decisions while trading.

- A Trading Plan mostly includes money management rules, strategy rules, entry and exit criteria.

- It can be created in a number of ways according to your preference. Eg. Long form, short form, tables, mind maps etc.

About Post Author

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.

Pingback: My 10-STEP trading process for complete beginners !! - ART OF HACKS