Nowadays, there are more ways to learn anything online, such as through YouTube videos, blogs, online courses, classes, and one-on-one coaching, among other things where almost all of the learning is available for free.

Regardless of the method of instruction, we must first learn all of the topics that must be covered in order to begin trading on your own and become consistently profitable.

Learning the theory is not enough to start trading and become profitable. Learning practical skills is just as important as learning theory.

But where can I learn about all of these topics?

Where to learn?

It is always preferable to begin with the fundamentals with an authorised or reputable organisation and then specialise whatever you want wherever you want.

Types of Trading Education

Online Courses

Reputable Platforms Offering Trading Courses

Picture this: a digital school that teaches you how to trade. These courses take you from knowing nothing to feeling confident. They’re like treasure maps that guide you through the trading world step by step.

You should also learn the fundamentals of finance. So take advantage of all of the free courses available on MOOC sites. Once you’ve mastered the fundamentals, you can look for courses that teach you how to trade.

Finance as well as trading courses are available on:

Udemy

Nse certified courses

Coursera etc

Interactive Video Lessons and Quizzes

Learning isn’t just reading words – it’s watching, listening, and doing. Imagine watching fun videos that teach you trading tricks and then answering quiz questions to see how much you’ve learned. It’s like a game that makes you smarter!

Self-study Resources

Websites

1. National Stock Exchange of India (NSE) , which is the leading stock exchange in India, is the go-to site for Indian traders.

You can learn about all of the trading concepts right here.

2. Courses or lessons provided by your trading platform like zerodha varsity etc.

You can also learn from other websites and YouTube channels like udemy, finlearnacademy,

https://finlearnacademy.com/

3. You can try investment and trading sites like babypips, investing.com, moneycontrol, economictimes etc.

Books

If you learn from online resources, you can try books written by reputable trading and investment mentors to boost your confidence.

The books listed below will help beginners understand trading basics as well as advanced concepts.

Trading in the zone

Investing for dummies

The disciplined trader

YouTube channels

These YouTube channels taught me a lot when I first started trading. I learned the market structure strategy from the Trading Channel YouTube channel. The UK spread betting YouTube channel is an educational channel that covers a variety of topics ranging from trading strategies to trading psychology.

These are the most reliable ways to learn trading.

Other methods

In-Person or Virtual Academies with Mentorship: Think of this like having a coach for trading. In these academies, someone experienced teaches you personally. It’s like having a friend who helps you when things get confusing.

Simulated Trading Environments for Practice: Imagine practicing trading without using real money. That’s what these academies offer – a safe place to practice. It’s like trying out your bike with training wheels before you ride on your own.

Methods of self-study include reading financial news, keeping a trading journal, and using trading software.

Attending live trading sessions and participating in online forums are examples of group learning methods.

Working with a mentor or studying with a group of classmates are examples of peer learning methods.

Watching financial news is one way to learn about trading. You can learn about the stock market and the economy by watching financial news. This information will assist you in understanding how markets operate.

A trading simulator is another way to learn how to trade. A trading simulator is a piece of software that teaches you how to trade stocks. Many financial institutions and online trading simulators are available.

Finally, you can learn how to trade by practising with real money. You can begin by trading small amounts of real money. You will learn how to make better stock trading decisions as you practise.

Key concepts to learn in Trading

A. Basics of Financial Markets

- Overview of Stocks, Forex, Commodities, Cryptocurrencies: Imagine a big marketplace where you can buy and sell things like shares of companies, currencies from different countries, precious metals like gold, and even digital money called cryptocurrencies. These are all part of the financial markets, where the trading action happens.

- Roles of Different Market Participants: Think of the financial markets as a stage where various players show up. There are people like investors, traders, and even big organizations like banks and governments. Each one plays a role in how prices move and decisions are made.

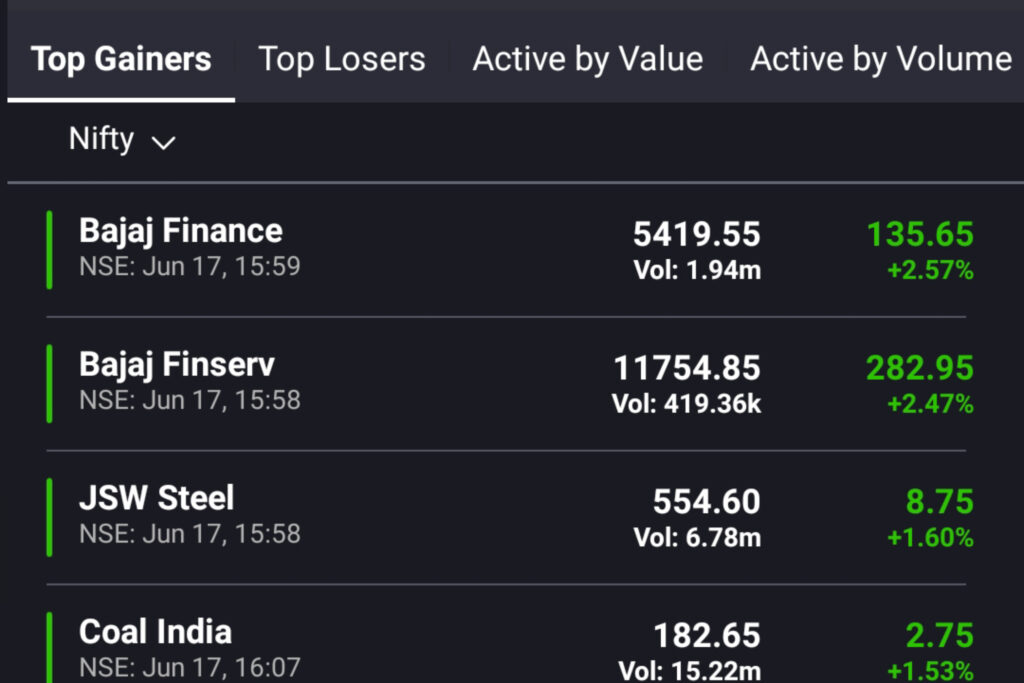

B. Technical Analysis

- Understanding Price Patterns and Indicators: Imagine looking at a puzzle of price charts. Technical analysis is like being a detective – you’re searching for patterns in these charts. It’s like noticing that when a certain pattern shows up, it often means something specific will happen next. Cool, right?

- Identifying Support, Resistance, and Trends: Imagine the price of something as a roller coaster. It goes up and down. Technical analysis helps you find spots where the price might pause or change direction. It’s like spotting where the roller coaster slows down before it starts climbing again.

C. Fundamental Analysis

Impact of Economic Indicators, Earnings Reports, and News: Ever notice how news affects things? Like when a company announces its earnings or when there’s big news about the economy. Fundamental analysis is like connecting these dots – understanding how news and events can make prices go up or down.

- Position Sizing, Setting Stop-Loss, and Take-Profit Levels: Imagine you’re playing a game, and you want to play smart. You wouldn’t put all your game tokens at risk at once, right? Risk management is like that – deciding how much to invest in each trade and having a plan to protect your money.

- Diversification Strategies for Risk Mitigation: Think of this as not putting all your eggs in one basket. Diversification means spreading your investments across different things. That way, if one thing doesn’t go well, the others can still help you stay afloat.

These fundamentals provide a foundation; as you grasp them, you’ll identify your subsequent learning path.

For other topics, check out this blog post..

Selecting a Learning Path

When it comes to learning about trading, think of it like choosing your adventure. Your journey begins by figuring out what you want from trading, what suits your style, and finding the right people to learn from.

A. Assessing Personal Goals

- Full-Time Trading or Supplemental Income: Are you in for the long haul, looking to make trading your main gig? Or is it more like a sidekick to your current income? Knowing this sets the tone for your approach.

- Risk Tolerance and Investment Capital: We all have different comfort levels with risk. Think about how much you’re okay with putting on the line. It’s like deciding how much you’re willing to bet on a game – you need to stay within your comfort zone.

B. Choosing a Trading Style

Aligning with Personality, Schedule, and Goals: Trading styles are like outfits – they need to match you. Do you like fast decisions, or are you more chill? Do you have time during the day to watch the markets or only at night? Picking the right style is like choosing an outfit that fits just right.

C. Researching Educators and Platforms

Checking Credentials, Reviews, and Course Content: Think of this like checking out reviews for a new restaurant. You want to make sure the place is good and the food is worth it. Similarly, before diving into trading education, check if the people teaching are legit and if others have had a good experience.

Practical Steps to Start Trading

Starting your trading journey is like taking your first steps. You need a strong foundation and a sense of direction.

A. Building a Strong Foundation

Devoting Time to Learning and Practice: Becoming a trader is like learning a new skill – it takes practice. You need to study and then test what you’ve learned. Imagine learning to ride a bike – you read about it, and then you practice until you get the hang of it.

B. Opening a Demo Account

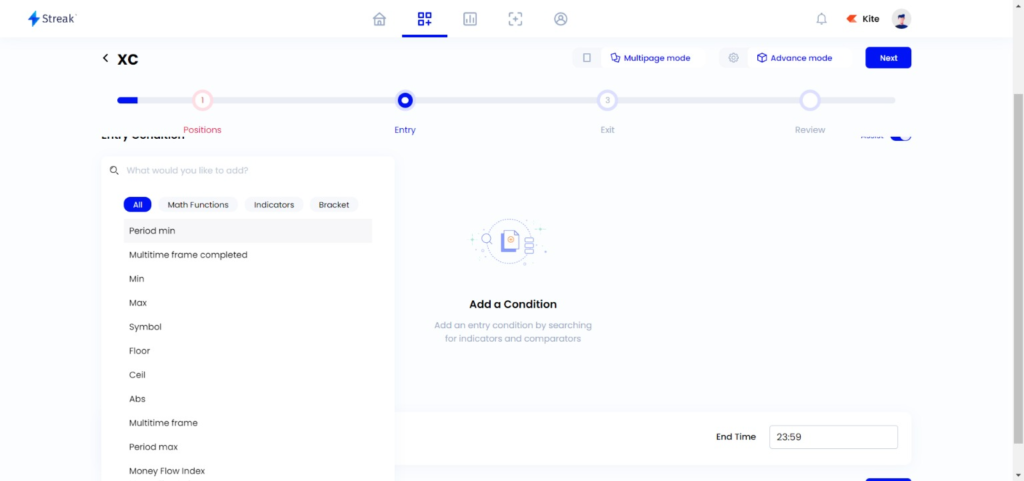

Practicing Without Real Money to Refine Skills: Picture this as training wheels for trading. A demo account lets you practice without using real money. It’s like learning to drive with a learner’s permit – you get to practice without the pressure.

C. Starting Small with Real Money

Using Disposable Income to Gain Market Experience: When you’re ready to trade with real money, start small. Think of it like dipping your toes into the water before you dive in. You’re getting the feel of the market without going all in.

Common Mistakes to Avoid

Trading can feel like a maze, but knowing the pitfalls can help you navigate it more smoothly.

A. Overtrading, Impatience, and Emotional Decisions

- Overtrading: Think of this like eating too much at a buffet. Overtrading can be like that – you’re doing too much, too fast. It’s better to trade wisely than trade often.

- Impatience: Imagine planting a tree and expecting it to be a giant oak overnight. Trading needs patience. Rushing into trades without a plan is like expecting a cake to bake in a minute – it won’t turn out right.

B. Neglecting Risk Management and Fundamental Analysis

- Neglecting Risk Management: Think of this as wearing a helmet while biking. Risk management is like protecting your head – it keeps you safe. Don’t invest more than you can afford to lose, and always have a backup plan.

- Neglecting Fundamental Analysis: It’s like baking a cake without knowing what ingredients you’re using. Fundamental analysis is understanding the ingredients that move the markets. Ignoring this can lead to trading disasters.

Evolving as a Trader

As you grow as a trader, it’s like becoming a pro in a sport. It takes continuous learning and a bit of self-analysis.

A. Continuous Learning

Staying Updated with Market Trends and Strategies: Imagine you’re a detective staying ahead of the game. As a trader, you need to keep up with market trends and new strategies. It’s like learning new dance moves to keep impressing the audience.

B. Keeping a Trading Journal

Documenting Trades and Analyzing Outcomes: Think of this as your trading diary. You jot down what you did, what worked, and what didn’t. It’s like keeping track of your scores in a game – you learn from each move you make.

My experience

When I learned about investing, I thought, “Why not buy and sell in the short term?” That’s how I discovered trading. Then I searched on Google and found out about the Zerodha platform. I began my trading education on Zerodha Varsity, and then I progressed to watching YouTube videos. Half of my learning was completed at that stage. The more crucial part came in the second half, where I conducted backtests, engaged in paper trading, and practised with small amounts of money. This second phase greatly aided me in comprehending emotional and money management.

About Post Author

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.