Can I buy any dip or bottom? What to do when the market goes down ? Should I buy crypto now?

No.

You cannot buy any dip.

As they say, “Don’t catch a falling knife” !

And it depends on various factors like technical analysis – trend pullback or reversal, fundamental analysis, short selling, time decay, time frame, how long you hold, news etc.

So, what is ‘buy the dip’?

Have you ever chatted with your pals about that whole “buy the dip” thing in trading? It’s a catchy phrase that’s buzzing around financial circles, and today, we’re diving deep into it. But before we do, let’s make sure we’re all on the same page.

When we talk about “buying the dip,” we’re basically talking about shopping for bargains in the stock market. It’s like scoring a killer deal on your favorite gadget, except in this case, the deal is a market downturn. But like any savvy shopper knows, there’s a catch – let’s break down the pros and cons.

Pros of Buying the Dip

A. Opportunity for Lower Prices

Picture this: you stroll into your go-to store, and that pricey item you’ve been eyeing is suddenly half off – that’s the essence of buying the dip. In the financial world, asset prices swing up and down like a pendulum. A dip is when they take a nose-dive. It’s like snatching up your dream car at a discount.

Throughout history, loads of investors have struck gold by buying the dip. Think about it: if you can snap up stocks at a discount during a dip, you’re setting yourself up for potential gains when the market bounces back.

B. Potential for Higher Returns

When you buy the dip, you’re essentially betting that the market will eventually bounce back. And history tends to back that up. Markets have a habit of recovering after going through a rough patch. If you’re in it for the long run, buying during a dip can lead to some pretty impressive returns over time.

Plus, getting in at a discount means you can potentially make even more when the asset’s value rises. It’s like buying a vintage comic book that becomes a collector’s item – except in this case, your “comic book” is a piece of a company.

C. Psychological Boost

Let’s not underestimate the psychological boost that comes with buying the dip. There’s something satisfying about knowing you’re getting a deal. It’s like finding a hidden treasure at a garage sale – it’s that feeling of “I’ve scored!”

What’s more, successfully buying the dip can boost your confidence as an investor. It’s like nailing that difficult guitar solo in a song – it’s a reminder that your strategy works.

Cons of Buying the Dip

A. Catching Falling Knives

But hold on, not everything’s sunshine and rainbows with buying the dip. Picture this: you’re trying to catch a falling knife – it’s risky, and you might end up hurting yourself. Similarly, trying to buy during a market crash can be a dicey move.

Sometimes, what looks like a dip can turn into a full-blown market meltdown. It’s crucial to distinguish between a temporary hiccup and a long-term crisis.

B. Timing and Predicting

One of the biggest challenges with buying the dip is timing. Can you really predict when the market has hit rock bottom? If not, you might end up buying too early or too late, which could spell losses instead of gains.

Folks who try to time the market often find themselves frustrated. The market’s a complex beast, influenced by a slew of factors, from economic data to global events.

C. Lack of Fundamental Change

Not all dips are created equal. Some happen because of market hysteria or short-term noise, while others are rooted in genuine problems with a company or the broader economy. It’s crucial to tell the difference.

If a dip results from deep-seated issues within a company, buying the dip might not be the smartest move. In such cases, it’s essential to dig deeper and understand what’s really going on.

Factors

1) To begin with, this dip or crash will only affect short-term traders.

Investors are usually well-researched or have financial analysts on their side.

This will not be an issue for day traders. They will simply go with the flow. Likewise, scalpers.

Short-term investors and swing traders, on the other hand, are in the most trouble.

2) You must first analyse the fundamentals of a stock. If the company is in debt or its performance is worsening, you may want to reconsider your decision to buy the dip. Because the stock may never recover. It may continue to fall.

3) If there is any news about the stock, there may be an immediate reaction. Then it will be able to recover.

4) Institutional traders may have anticipated this and purchased it, resulting in a sharp drop when the news is released.

5) In some volatile markets, such as cryptocurrency, there can be frequent spikes or crashes. In that case, you should also know about technical matters.

6) It also depends on how long you hold the position. Short-term dips are nothing to worry about if you are a long-term investor. If you are a short-term trader, however, you should exit before you violate your risk management rule.

7) Time decay is another consideration. If you buy options and hold them, this dip will be your worst nightmare. When you see that the dip is going to continue, get out as soon as possible. Because you don’t want your price to fall due to time decay.

8) It is determined by the type of trade. Short or long. PE or CE? You have just hit the jackpot if you are short selling, buying a PE, or selling a CE. If not, you should think about exiting your trades.

There are more factors to consider but these are the basic factors.

What should I do?

When the market is crashing, first examine the company’s fundamentals.

Look at the news and especially if you are only trading an index. The market will be influenced by both local and global factors.

Then determine whether it is simply a large pullback or a trend reversal.

If everything points to a negative market, do not trade and exit your previous positions.

However, if you want to profit from this crash, you can use futures and options to go with the flow or do intraday short selling.

How do I buy at the cheapest price?

If you want to buy the stock at the lowest possible price, consider all of the above factors and ensure they are no longer a factor.

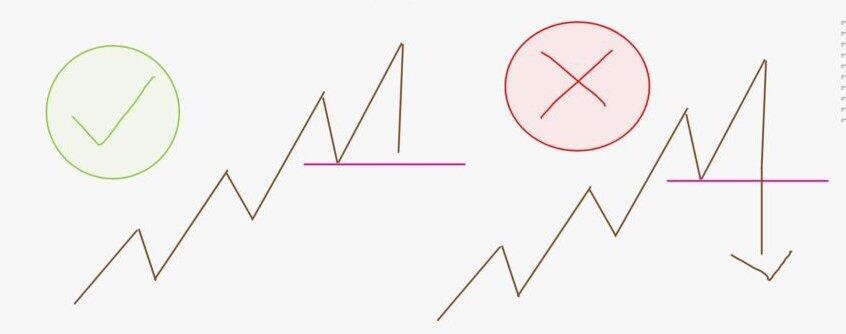

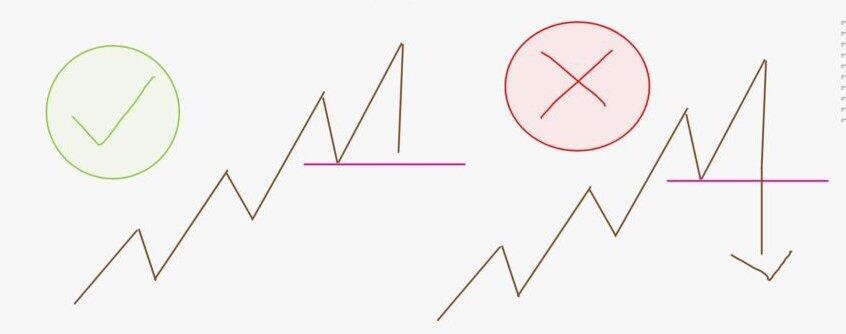

When the price begins to rise, do not buy it right away.

Wait for the previous downtrend pullback to be broken. Then, after a pullback, enter.

If all other factors remain constant, this would be the cheapest price possible.

My Profit / Loss Example

Here, in this example, I bought DOGE/INR after it broke previous pullback level at 7. So, I bought it at 9. If there is no break near previous pullback, it is not advisable to buy the dip. As it might further go down below 4. So, If you are a trader, there are better strategies to trade. But if you are an investor, this strategy is worth checking out.

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.