You may have heard all the traders preaching NEVER TRADE WITHOUT STOPLOSS.

Some even argue that using a stop loss will not result in profits. And so on…

“Stoploss, stoploss, stoploss,” you hear this everywhere you go to learn trading.

So, what exactly is a stop loss? How to use stop loss? Why is everyone going on and on about it?

What is a Stop Loss ?

A stop loss is a type of order used to buy or sell an asset.

This is the point beyond which you do not want the price to move. This is done in order to prevent huge losses or wiping out your entire trading account.

You can keep 1$ / 100 pips / 1% as stop loss depending upon your trading strategy and risk management.

Once you place the SL order, it will be automatically executed once it reaches your stop loss.

Stop loss example

If this seems confusing to you, look at the following example.

Eg. Going long

If you buy your stock at price 100 and wish to sell at 150, you place your target at 130 after entering the position.

The stock goes in your favour…

100 →120

Yay.. You have got 10 points profit. You leave the room feeling great about your achievement.

You come back after an hour..

This happens..

120→95

(just before reaching the target..)

Ouch… !

It hurts…

You never know when the price would reverse or give a pullback.

That is why you set your stop loss according to your risk management strategy.

Here, I would place my stop loss at 70.

i.e 1:1 risk reward ratio.

So, it becomes..

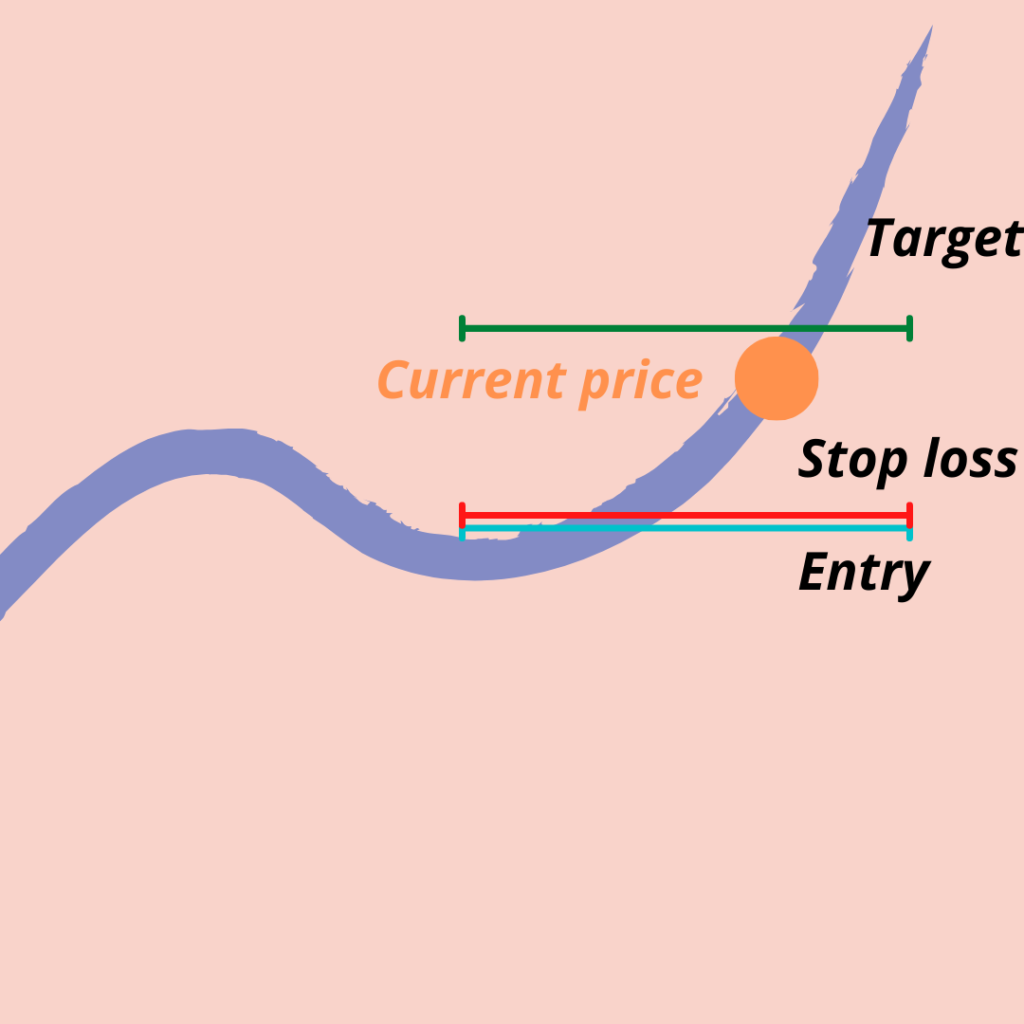

Entry price – 100

Target – 130

Stop loss – 70

So, 30 points is your stop loss.

Now it means you do not want your price to go below 70.

If your quantity is 10, and capital is 10*100 = 1000$, you don’t want to lose more than 10*30 = 300$.

You still have 10*70=700$ to use for your next trade, even if you lose.

So, your risk management goes like this..

Entry @ 100

Target @ 130

Stop loss @ 70

→700$ protected if price moves against you.

Why stop loss?

Stop loss protects your capital. Even a professional or a genius cannot be completely correct in the stock market.

Think about it.

There was no such thing as stoploss in the past. You’d have to keep an eye on the market for the entire market hours. And, if it was a positional trade, there were large, unexpected losses.

Tough, right?

With the stop loss, it becomes easy and controllable. You can set a stop loss and leave. There’s no need to keep an eye on the market. It also prevents you from losing your entire capital.

Stop loss pros and cons

Pros

1. Protects your capital.

2. It is free and easy to use. You don’t have to set up a complex system to automate your risk management.

2. Set-and-forget. You don’t have to watch the market every minute. The order will be executed automatically.

3. It helps manage your emotions as you are away from your screen but still protecting your capital.

4. Your risk % can become a profit by trailing your stop loss.

Cons

1. Not useful for investments.

2. Sometimes it just doesn’t work during to gaps, spikes etc. The order may get executed at the next available price.

3. If you do it wrong, you may have frequent losses.

Stoploss hunting

Stop loss hunting is a practice where stock market operators or big institutions intentionally try to hunt the stop loss of retail traders, so that they can profit from our losses.

The best way to avoid this is to use ATR value for stop loss. This reduces your chances of stop loss hunting as ATR takes into consideration the normal volatility of the stock.

Types of stoploss

Types of stop loss includes placing your stop loss in different order types, which are limit, market, trailing stop loss, buy stop and sell stop.

Stop loss at market price – If you want your stop loss order to be placed at any nearby value available.

Stop loss at limit price – If you want your stop loss order to be placed at your desired price.

Buy Stop loss – If you want your stop loss to be placed at a price higher than the current market price, when the market is going up.

Sell Stop loss – If you want your stop loss to be placed at a price lower than the current market price, when the market is going down.

Trailing stop loss – Trailing stop loss is used when you want to lock in your profits when the market moves in your direction. This is done by changing your stop loss in your direction, by a certain percentage when the price moves in your direction, by a certain percentage.

Calculate stoploss

To calculate your stop loss, you should plan your entry price.

Entry price – Risk = Stop loss price for long position.

Entry price + Risk = Stop loss price for short position.

Example

Entry = 100

Risk = 10

Stop loss for long trade = 100 – 10 = @ 90.

Stop loss for short trade = 100 + 10 = @ 110.

How to place trailing stop loss?

Stop loss is usually placed away from the entry in the opposite direction of your prediction.

Once the price starts moving in your favour, you can change the stop loss to be placed at the entry point. In this way, you can be at breakeven.

Once it reaches your target, you can exit the trade by booking the profit.

Or else, you can let the price go beyond your target and move your stop loss few points away from the entry point, in your direction. This is called trailing stop loss.

How to use stop loss in your trading platform ?

Check out this video to set up a stop loss in Zerodha platform. Almost all the platforms use the same options to place a stop loss order.

Best practices

In order to protect your capital and still be on the right trade without getting fake stop loss hits, these are the 2 best practices I found very effective which I am still using till date.

1. 1-2% of your capital should be your stop loss per trade.

This is done in order to protect your capital from the common drawdowns seen in any strategy.

This way you don’t blow your account and still have sufficient capital to trade after consecutive losses.

2. 1-2 * ATR near recent swing point. This is the most important tip I have learned which makes my trading simpler and profitable.

Always have your stop loss below your swing point ( when the long entry is nearby recent swing point ) minus the ATR value at that particular time.

And have your stop loss above your swing point ( when the short entry is nearby recent swing point ) plus the ATR value at that particular time.

This works like magic because the ATR value is the AVERAGE TRUE RANGE of the stock at the current price, which also considers the normal volatility of the stock at that moment.

This can help you prevent stop loss hunting and stop loss confusions.

I can’t stress it enough…

It almost always works !

* I use the word ‘almost’ every time because nothing works in stock market 100% of the time. It is just about the accuracy. So, in trading terms, ‘almost always’ means it is the BEST among the other ones.

TIP : COMBINE BOTH TO HAVE THE MOST PROFITABLE STOP LOSS !

Tools to help you place stop loss

These 2 tools help me calculate my stop loss faster during day trading.

1. Tradingview drawing tool helps you identify your risk reward ratio quickly.

Just go to the drawing tools in tradingview → select long position tool / short position tool.

2. Stoploss calculators helps you calculate your stop loss faster. No more guessings and mental calculations.

Just enter your entry point, recent swing level, ATR value and the multiplier, you are good to go. You will have your stop loss in no time.

You can find the stop loss calculator below.

About Post Author

Pingback: My 10-STEP trading process for complete beginners !! (No.2 is imp) - ART OF HACKS

Pingback: My top 3 reliable technical indicators ! And how I use it? - ART OF HACKS