Notion for Traders

In the world of trading, it’s vital to stay organized and manage information effectively. Traders need to keep up with market trends, use strategies, and control their emotions. That’s where Notion, a useful tool, comes into play.

In this blog post, we’ll explain why Notion is so important for traders. Notion helps traders with education, strategy, backtesting, journaling, and emotional management.

We’ll show you how Notion’s features can be used in trading, making it easier to succeed.

Whether you’re new to trading or experienced, Notion can improve your trading experience. It helps you make better decisions and enhances your journey as a trader. Join us to discover how Notion can be a game-changer for traders.

Notion use-cases

Notion is a versatile platform that can be incredibly useful for traders in various aspects of their trading journey.

Get the Notion Trading dashboard here

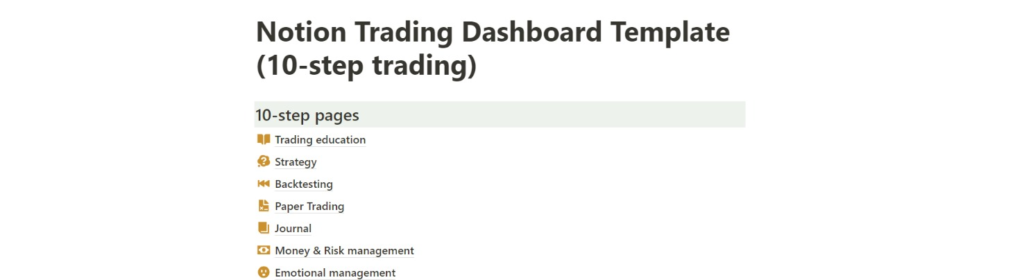

Here’s how Notion can be used at different steps in your trading journey:

Pages

- Trading Education: You can create a page dedicated to your trading education, where you can compile articles, videos, and notes on trading strategies, market analysis, and educational resources.

- Strategy: Develop a page to outline and document your trading strategies. This can include detailed descriptions of your strategies, entry and exit criteria, and performance analysis.

- Backtesting: Use Notion to record and analyze the results of your backtesting efforts. Create tables and charts to visualize the performance of different trading strategies over historical data.

- Journal: Maintain a trading journal within Notion. Record your daily trades, emotions, and lessons learned. This can help you identify patterns and continuously improve your trading skills.

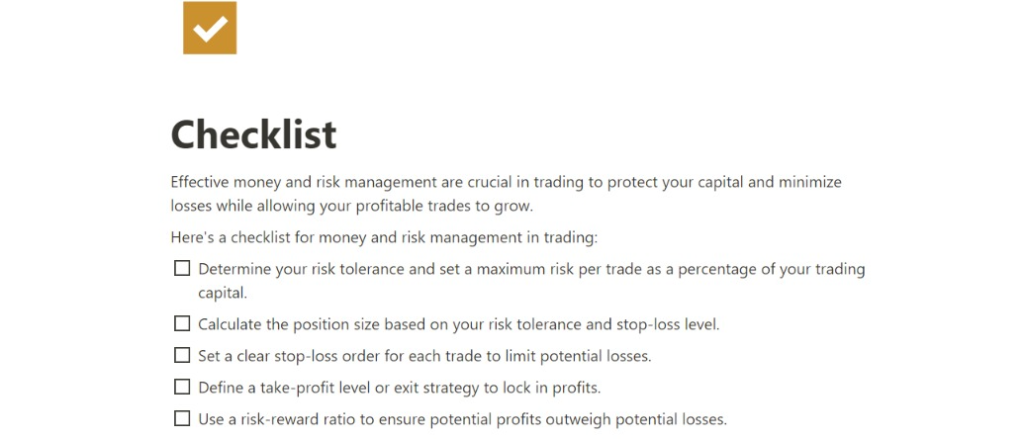

- Risk & Money Management: Dedicate a page to risk and money management. Calculate position sizes, set stop-loss orders, and track your overall risk exposure.

- Emotional Management: Keep a section for emotional management. Document your emotions before, during, and after trades to identify any psychological biases that may impact your trading decisions.

- Paper Trading: Create a section to simulate trades in a paper trading environment. This can help you practice your strategies without risking real capital.

- Trading Plan: Develop a comprehensive trading plan, including your goals, risk tolerance, and guidelines for your trading activities. Notion can help you keep this plan well-organized and accessible.

- Open a Trading Account: Store information about your trading accounts, including broker details, account numbers, and login credentials securely.

- Start Small: Keep a section focused on the importance of starting with a small trading capital and gradually increasing it as you gain experience and confidence.

Databases & Tables

- Trading Education: Create a database of trading books, courses, and resources. Include details like the title, author, publication date, and your personal ratings and comments. You can sort and filter this information to prioritize your learning.

- Strategy: Build a table to track your trading strategies. Include columns for strategy name, entry and exit criteria, timeframes, and performance metrics. This allows you to easily compare the effectiveness of different strategies over time.

- Backtesting: Create a database to record the results of backtests. Include information like the date of the test, the asset or instrument tested, and the performance metrics such as profit/loss, win rate, and drawdown. Analyzing this data can help refine your strategies.

- Journal: Use tables to maintain a trading journal. Record the date, trade details (entry and exit prices, size, asset), and emotional notes. This structured approach helps you identify patterns in your trading behavior.

- Risk & Money Management: Create a table to calculate and track position sizes based on your risk tolerance and available capital. Include columns for stop-loss levels, position size, and risk percentage. This ensures that you adhere to your risk management rules.

- Emotional Management: Build a table to track your emotions before, during, and after trades. Use a scale to rate your emotional state and note any psychological factors that influenced your trading decisions.

- Paper Trading: Maintain a database for paper trading results. Record trade details, entry and exit points, and reasons for the trade. This allows you to evaluate your performance in a simulated environment.

- Trading Plan: Use tables to create a comprehensive trading plan with sections for goals, risk tolerance, asset allocation, and rules for different scenarios. This acts as a reference point for your trading activities.

- Open a Trading Account: Keep a table with your trading account information, including broker details, account types, account numbers, and login credentials. This ensures you have all the necessary information at your fingertips.

- Start Small: Create a table to track your progress as you start with a small trading capital. Include columns for initial capital, current capital, and percentage growth. This allows you to see how your capital is growing over time.

These databases and tables help traders maintain a structured approach to their trading activities, enabling them to make informed decisions, track progress, and continuously improve their strategies and performance. Notion’s customizable tables make it easy to adapt to the specific needs of each trader.

To-Do List & Reminders

- Trading Education:

- Research new trading strategies or techniques.

- Schedule time for reading trading books and articles.

- Set reminders for attending webinars or online courses.

- Strategy:

- Create a to-do list for developing and refining trading strategies.

- Set specific tasks like testing new indicators or fine-tuning entry and exit criteria.

- Plan strategy reviews and adjustments on a regular basis.

- Backtesting:

- Schedule backtesting sessions to evaluate different strategies.

- Set tasks for data collection and analysis.

- Review and refine strategies based on backtesting results.

- Journal:

- Daily task to update the trading journal with trade details and emotions.

- Set reminders for weekly or monthly journal reviews.

- Identify patterns in your trading behavior and set tasks to address them.

- Risk & Money Management:

- Regularly review and update risk management rules and position sizing calculations.

- Set reminders for risk assessment before each trade.

- Plan adjustments to risk levels as your trading capital grows or shrinks.

- Emotional Management:

- Create tasks for managing emotions, such as daily mindfulness exercises or journaling.

- Schedule periodic self-assessments to gauge emotional well-being.

- Set reminders to stay disciplined and avoid impulsive decisions.

- Paper Trading:

- Maintain a to-do list for your paper trading activities.

- Set tasks for entering paper trades, tracking results, and analyzing performance.

- Schedule regular reviews and adjustments to your paper trading strategies.

- Trading Plan:

- List tasks for creating, updating, or revising your trading plan.

- Schedule regular reviews to ensure you’re following your plan.

- Set reminders for adapting the plan to changing market conditions.

- Open a Trading Account:

- Create a checklist of tasks to open a new trading account.

- Include items like completing paperwork, verifying identity, and depositing funds.

- Check off each task as it’s completed to ensure a smooth account setup.

- Start Small:

- Plan tasks for managing a small trading capital effectively.

- Set goals for capital growth and regularly assess progress.

- Adjust strategies as your capital grows, always adhering to your risk management rules.

Notion’s to-do lists allow traders to break down their trading-related tasks into manageable steps, ensuring that nothing is overlooked, and that they stay on top of their trading activities. This can help traders maintain discipline and focus in a fast-paced and dynamic trading environment.

Files, Images & Videos

- Trading Education:

- Store e-books, PDFs, or videos related to trading techniques, market analysis, and educational resources.

- Attach images of trading charts or diagrams to illustrate concepts.

- Create a library of educational videos for quick reference.

- Strategy:

- Attach images or screenshots of historical trading charts to visualize strategy performance.

- Store video recordings of strategy simulations or live trading sessions for review.

- Include files with strategy code or scripts for reference.

- Backtesting:

- Save historical market data in files for backtesting purposes.

- Attach screenshots of backtesting results to track the performance of different strategies.

- Include videos of backtesting sessions to review your analysis process.

- Journal:

- Add images or charts to your journal entries to provide visual context for your trades.

- Attach videos documenting your emotional state during critical trading moments.

- Store files related to any external factors influencing your trading decisions.

- Risk & Money Management:

- Include spreadsheets or documents with calculations for position sizing and risk assessments.

- Attach images or charts illustrating risk exposure and potential losses.

- Store educational videos on risk management principles for reference.

- Emotional Management:

- Attach videos or audio recordings of your mindfulness or emotional management exercises.

- Add images of calming visuals or motivational quotes to your emotional management section.

- Include files with articles or resources on maintaining emotional discipline.

- Paper Trading:

- Attach files containing records of your paper trades and their outcomes.

- Store images of paper trading simulations to compare with real trading results.

- Include videos of your paper trading sessions to review your decision-making process.

- Trading Plan:

- Attach the trading plan document itself, ensuring easy access and frequent reference.

- Include charts or visual aids illustrating your asset allocation and diversification strategies.

- Add video recordings explaining the key components of your trading plan.

- Open a Trading Account:

- Store account opening documents, scanned IDs, and agreements as files.

- Attach images of your trading account dashboard or login screens.

- Include video tutorials on how to navigate your trading platform.

- Start Small:

- Attach files with records of your initial capital and its allocation.

- Include images or screenshots of your trading account statements as it grows.

- Store videos documenting your trading journey from the early stages to more substantial capital.

Notion allows traders to create a comprehensive digital trading library, making it easy to access, analyze, and reference visual data and materials critical for their trading strategies and decision-making processes.

Embed

- Trading Education:

- Add economic calendars to track important economic announcements and their potential impact on markets.

- Strategy:

- Embed live trading charts from your preferred trading platform for real-time technical analysis.

- Integrate widgets that display key technical indicators and signals directly on your strategy page.

- Backtesting:

- Embed interactive historical price charts for the assets you are backtesting to visualize performance over time.

- Include live data sources to ensure your backtests use the most up-to-date historical data.

- Journal:

- Embed a mood or emotion tracking app or widget to record your emotional state during trading sessions.

- Add widgets that provide prompts for journal entries, making it easier to maintain a consistent journaling practice.

- Risk & Money Management:

- Embed calculators that dynamically adjust position sizes based on risk parameters and account balance.

- Include widgets that show live account balance and equity to help with real-time risk assessment.

- Emotional Management:

- Embed mindfulness or meditation apps for quick access to relaxation exercises before trading.

- Include widgets that provide psychological tips and strategies for emotional control during trading.

- Paper Trading:

- Embed paper trading simulators or platforms to practice trading with real-time market data.

- Add widgets that display your paper trading performance statistics for analysis and improvement.

- Trading Plan:

- Embed live financial news widgets to track market conditions relevant to your trading plan.

- Include widgets displaying economic data releases and financial events that may impact your plan.

- Open a Trading Account:

- Embed broker application forms or account opening widgets for direct access to account setup.

- Include widgets that display real-time brokerage promotions or offers to compare before opening an account.

- Start Small:

- Embed financial portfolio trackers to monitor the growth of your trading capital over time.

- Add widgets that provide investment tips for traders looking to grow their capital gradually.

The “Embed” feature in Notion offers traders the ability to bring real-time data, widgets, and external information directly into their workspace. This can help them make more informed decisions and stay updated on market events without leaving their Notion pages, enhancing their trading capabilities.

Other uses

Notion buttons can be used to create templates that can be replicated whenever needed. These templates can be designed for various purposes, such as journal entries, backtesting, and more. You can also customize elements like colors, toggle lists, and headings to organize your Notion page.

My experience

I use Notion to digitally organize every aspect of my life. Currently, I’m using Notion for backtesting, paper trading, and journaling my trades. I’ve created a separate page for each of the 10 steps in trading, along with corresponding blocks in each page.

Conclusion

In a nutshell, Notion is a game-changer for traders. It helps you organize your trading journey, from learning and strategy development to tracking your trades and managing your emotions.

With Notion, you can create pages, tables, and to-do lists, store files, images, and videos, and even connect to live data.

By using Notion, you’ll become a more organized and informed trader, making better decisions and increasing your chances of success in the markets.

So, if you’re serious about improving your trading, give Notion a try—it’s a powerful tool that can make a real difference in your trading journey.

I hope you found this post helpful. I will soon publish more dedicated posts for each specific use case.

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.