How did I get into market structure trading?

Whenever I enter a trade, I make quick profits. Everything went well.

But then I start losing money. I was convinced that loss is unavoidable and that there was no reason to be concerned.

But what happened later surprised me….

I had my first loss.

Then four consecutive losses…

I knew this is referred to as a losing streak. And it happens with any strategy. But the truth is that I was not at peace with it.

I was confused and frustrated.

I felt like this didn’t work for me.

Then I changed my strategy.

& Then REPEAT.

This kind of inconsistency was primarily due to my lack of understanding of the market’s basic price action.

Then I began learning all of the possible strategies, and when I began learning price action, I learned about support and resistance.

I liked it because you can pre-plan your target and stop loss.

Apart from that, I don’t understand why there are so many levels of support and resistance, and where should I place the trade?

So, I started learning all about price action and that’s where I came to know about market structure.

And, now this is the only strategy I use to trade almost anything – swing, intraday, stocks, crypto, derivatives etc.

Here, we’ll see about market structure. You can use this strategy on any time frame or on any asset, top gainer or loser, top volume etc.

This is a high probability setup so if you understand this concept, you will never go back to any other strategy.

So, let’s start with some basic market structure concepts to remember !

Market structure basics

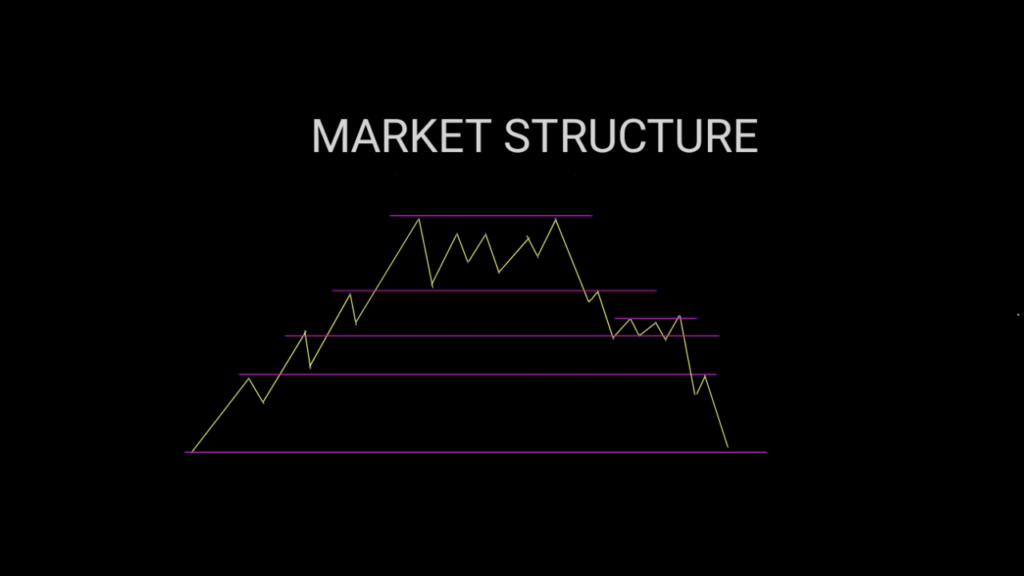

1) According to the market Structure theory, any market would contain these two things that is one is trend and the second one is support and resistance.

2) And any trend would contain these three things :

Uptrend,

Consolidation &

Downtrend.

3) And these are the main three things in a trend :

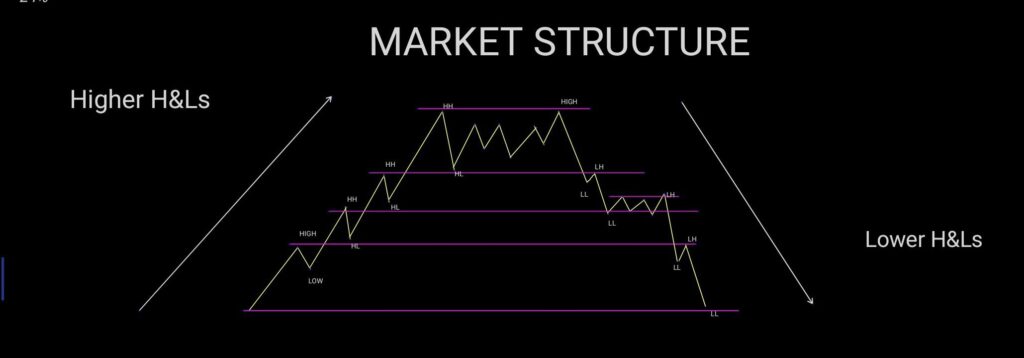

In an uptrend, the highs will be always higher than the previous high. And In a downtrend the current low will always be lower than the previous low.

In consolidation the price always moves within a range.

4) Another concept is any price would move from one level of support and resistance to another level of supported resistance.

The Strategy

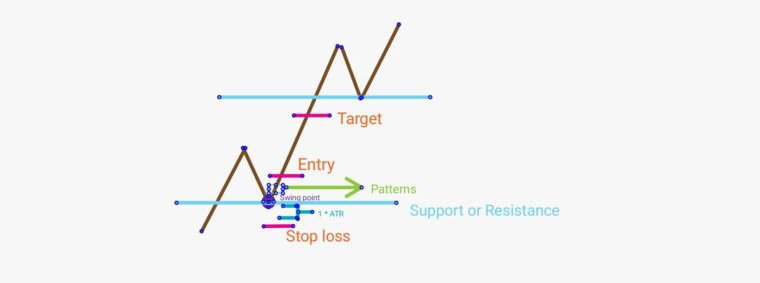

So the basic strategy would be to

Enter = at the pullback of a trend.

Stop loss = 1*ATR away from the pullback.

Target = according to your risk reward ratio / next level of support and resistance.

Trend identification

But the main problem with this is the trend is not always perfect. It is not always in a very clear zigzag pattern. It will be very confusing so we’ll have to understand the structure of a trend and then we’ll have to draw it accordingly.

Just make sure the highs and lows are always higher than the previous ones in an uptrend. And highs and lows should always be lower than the previous ones in an downtrend.

You can also draw horizontal lines near the swings so that it will be easy to track if it breaks out and gives a pullback.

Or you can use numbers like h1, l1, h2, l2 etc to make it less confusing.

Check out the video below to watch it in action.

Confirmation-1

As we know that the price moves from one level of support in resistance to the other level, we can use this as the first level of confirmation.

The pullback should be at the level of support and resistance only then you can take an entry.

But for target you can either use it according to your risk reward ratio or fix your target at the next level of support or resistance.

So this confirmation will increase your probability of success.

Confirmation-2

Now when a pullback starts to form, just look for a pattern or at least an indicator signal before taking an entry. This would give an extra layer of confirmation.

For example, you can say if a bullish candle is formed after the pullback I will take an entry or you can use a moving average to confirm the entry.

Confirmation-3

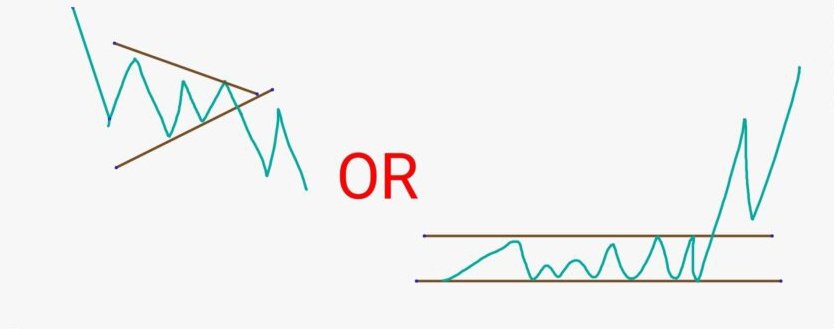

Another layer of confirmation is to always enter at the beginning of the trend.

This is done by trading only on trends after a consolidation breakout.

The consolidation can be in any form. It can be in a horizontal form or a pattern or anything in range.

So whenever you find a breakout like this, this is where you will take an entry or at least second one. After third or fourth don’t take an entry.

The 1st and 2nd is preferable and the third is somewhat okay if you are a risky trader. And there is no chance for fourth and fifth but if it is there it is bit risky.

So when the consolidation pattern is broken and then a trend starts, that trend is usually very very strong.

Confirmation for reversal

If you want to find whether it’s a pullback or reversal, if the price breaks the previous level of a pullback then it is considered as a reversal.

Example

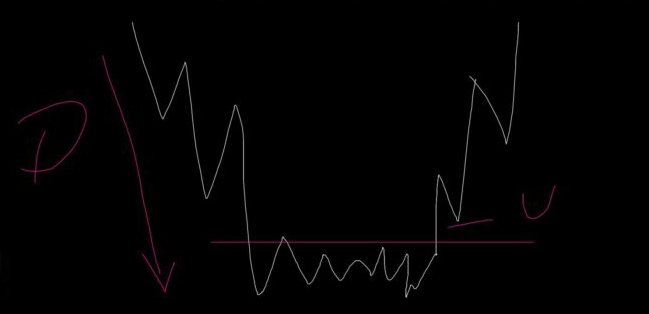

For example, let’s take this chart.

A small uptrend is formed here (Blue trend line).

As it breaks this previous level of pullback (1st horizontal line) we can say that the uptrend has ended and the downtrend has started.

And also there is a rejection or a pullback at the start of the downtrend so that is another layer of confirmation. so we can take an entry here.

Now the downtrend has started so let’s draw some lines to find an entry.

We will mark the highs and lows. (Blue zig zag lines). The first 2 highs and lows are marked and drawn as a connected line.

But for the third one, you should not take an entry because it did not break the previous low so just mark the high and wait for the low to be broken and then we can take an entry at the pullback.

So that’s it this is the basic of any market structure.

All you have to do is

Mark the trend,

Look for support and resistance,

Add layers of confirmations for entry like pattern or indicator or a range breakout,

To be more safe always take an entry at the start of the trend and always take an entry at the pullback of a trend,

Set the stop loss 1*ATR away from the swing point &

Set the target according to your risk reward ratio/next level of support and resistance (whichever is closer to your money management rules).

Check out my youtube video to watch the strategy in action…

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.

Pingback: Why does the stock price move against me when I take a trade? - ART OF HACKS

Pingback: My top 3 high probability price action strategies ! - ART OF HACKS

Pingback: Can I buy any dip or bottom? What should I do when the market crashes? Should I buy crypto now? - ART OF HACKS

Pingback: What is the best crypto currencies to buy right now ? (Quick updates thread) - ART OF HACKS