Why is trading so stressful ?

While investing is one of the easiest ways to make more money, trading is the most stressful way to make easy money.

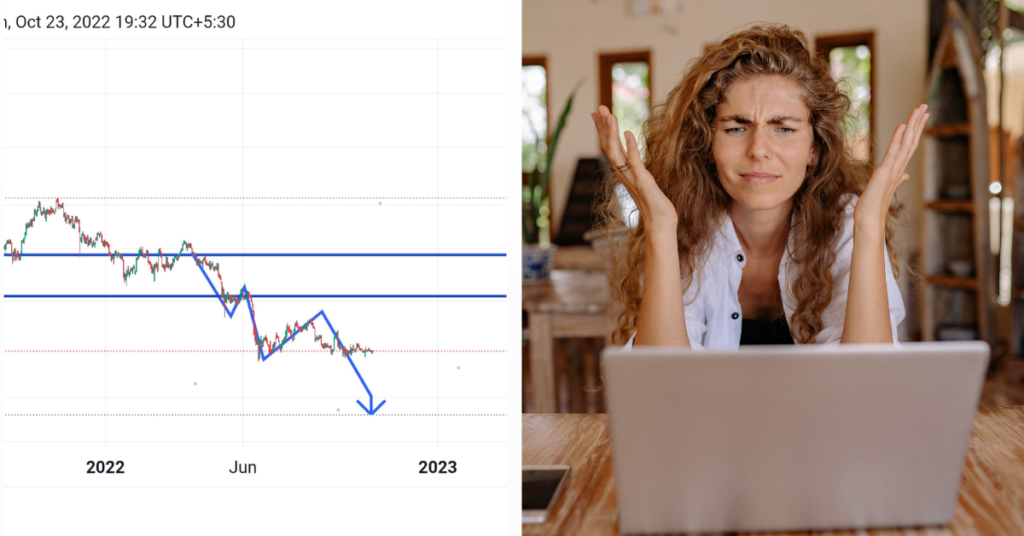

This is mainly because the market moves randomly, and we don’t have a clear-cut method to win all the time.

We might lose our money due to uncertainty, causing stress that, in turn, leads to making wrong decisions at the wrong time, resulting in significant losses.

To avoid the impact of stress on our finances and well-being, we need to understand the sources of stress.

In this post, let’s explore the sources, effects, and ways to prevent it.

Uncertainty

The sources of stress in trading are similar to those in real life, stemming from the uncertainty of the market. Even with proper backtesting and careful analysis, entering a position may not guarantee reaching the target as expected.

Breakouts may reverse, giving a false signal, or just before reaching the target, a reversal could hit the stop loss.

This unpredictability may lead beginners to either leave the market or lose hope in making money.

Solution

The solution to uncertainty is to accept it and find a way to profit. Create a plan based on available certainties, stick to it, have a clear strategy, backup capital for emergencies, and always have a plan B.

Financial risk

The risk of losing money is ever-present, and even seasoned experts encounter losses in their careers.

Losses themselves aren’t an issue; the problem arises when they deviate from your trading plan.

Consecutive losses can trigger stress and anxiety, potentially leading to further financial losses.

Beginners, in particular, may enter a “revenge mode” in an attempt to recover losses.

Experienced traders, however, maintain a steadfast commitment to a well-established trading plan, which serves as a crucial safeguard against impulsive reactions.

Solution

Effective solutions to manage financial risk in trading include avoiding immediate attempts to recover lost money, as this can add additional pressure.

Acknowledge the inherent possibility of losses in the market and prioritize a profitable risk management strategy.

Always maintain backup capital to cover potential losses and expenses.

Give importance to a solid trading plan and the discipline to stick to it.

Create, backtest, and document a trading strategy, including noting drawdown, and adhere to it consistently.

Following these steps has proven effective in preventing stress associated with financial risk in my experience.

Pressure

The constant pressure to generate income from the market can lead to stress, potentially fueling greed and prompting poor decisions.

Solution

A solution to alleviate this pressure is to diversify income sources, ideally incorporating a stable, fixed income stream.

This approach provides financial stability, reducing the dependency on market performance and mitigating the emotional impact of trading decisions.

Emotional influence

Emotions from various aspects of life can contribute to stress, especially in day trading.

Solution

Maintaining emotional control is crucial, but for those who struggle, integrating relaxation techniques such as meditation, breathing exercises, journaling, or spending time in nature can help manage stress.

Alternatively, exploring different trading strategies like swing trading, equity, or commodity trading based on individual risk appetite can provide a less emotionally taxing approach to trading.

Isolation

Solitude is a prevalent source of stress for traders, given the independent nature of their work, involving analysis, review, and trading in isolation.

The absence of social support can contribute to stress, a common challenge particularly for those starting out.

Solution

To counteract this, it is essential to actively maintain social connections by regularly meeting friends and family, even for introverts.

Breaking the isolation through social interactions helps alleviate stress and fosters a healthier trading mindset.

Other Causes

- Constant Mobility: Traders are always on the move, adapting to rapidly changing market conditions, leading to heightened stress levels.

- Time Pressure: The necessity for quick decisions in trading intensifies stress, mirroring the pace seen in high-pressure environments like investment banking.

- Knowledge Competition: Traders face the stress of competing with others in the market, continually striving to stay ahead in terms of information and insights.

- Capital Concerns: The pressure associated with managing trading capital and the fear of potential losses contribute significantly to stress levels.

- Emotional Resilience Challenge: Emotional resilience is crucial for traders dealing with numerous tasks, uncertain outcomes, and the possibility of losses.

- Technical Challenges: Stress can arise from various technical issues, including errors in setting stop-loss orders, technical glitches, and the constant threat of stop-loss hunting.

- Biological Factors: Biological elements such as brain energy consumption, cortisol release, and the surge of adrenaline during trades contribute to the trader’s stress.

- Information Overload: The overwhelming influx of information in the market can create a vicious cycle of stress, impacting decision-making abilities.

Other Tips

- Self-awareness: Recognize subtle signs of stress, burnout, and specific emotional, physical, mental, and behavioral indicators.

- Emotional Expression: Expressing feelings about trades, outcomes, and stresses is crucial for mental well-being.

- Lower Expectations: Realistic expectations and acceptance of losses are vital to mitigating stress in trading.

- Mindfulness Techniques: Incorporate mindfulness exercises, Emotional Freedom Techniques (EFT), breaks, and relaxation strategies.

- Physical Well-being: Prioritize exercise, maintain a work-life balance, and consider relaxation practices to combat stress.

About Post Author