Because emotions and reality comes into play.

Why trading is difficult?

1. Trading is hard because it involves trying to predict what other people are going to do. The markets are always changing and can be unpredictable, making it difficult to predict the direction of prices. So there’s no one-size-fits-all answer, so it takes a lot of practice, research and experience to get good at trading.

2. Trading is difficult because there are so many factors to consider, such as the markets, economic conditions, company fundamentals, financial instruments, and personal risk tolerance.

3. There is also the potential for significant losses if trades are not managed carefully. Additionally, trading costs such as commissions, fees, and taxes can take away from potential profits.

4. And also, trading can be an emotional roller coaster, and it is important to be able to manage your emotions while trading.

5. It is difficult because you don’t follow your own trading rules. Nobody is disciplined and strict all the time. All humans have different emotions every day and it is difficult to control it all the time. As a result, you are bound to make mistakes which will result in potential losses.

6. It may also depend on your personality and your trading style. A calm and composed person may find day trading hard because of it’s fast paced nature. Similarly, a very active person may find swing trading too slow and difficult to manage their emotions.

It is not always buy low and sell high !

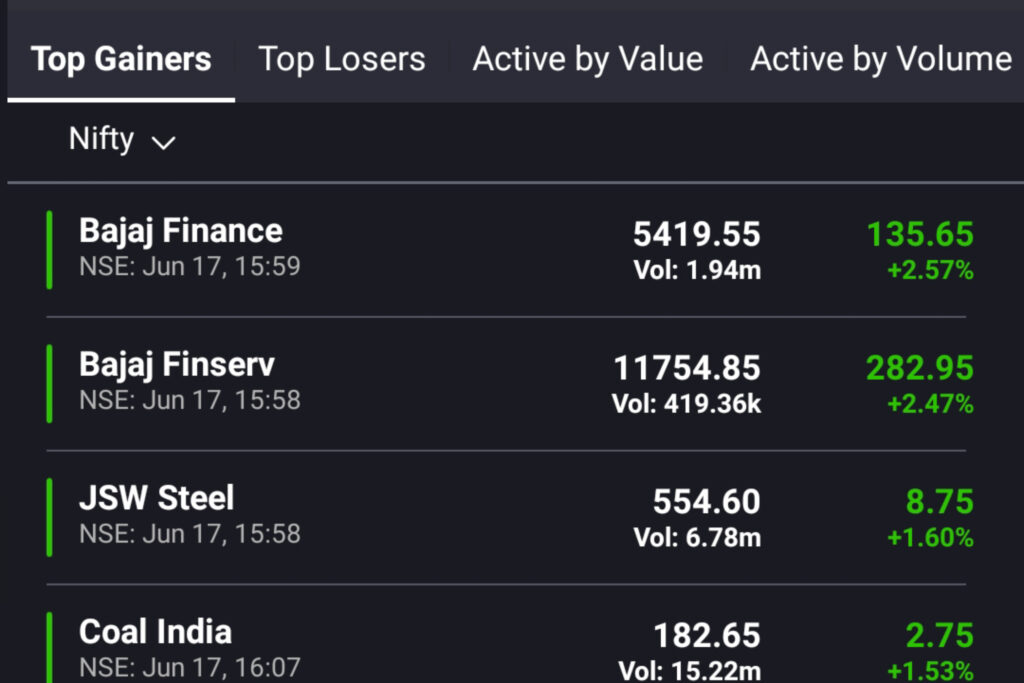

1. It is not always buy low and sell high. You might experience huge losses if you follow it blindly. You should clearly know which price is lower and which is higher.

You should be aware of the technical concepts like market structure and know where the downtrend has stopped and the stock is looking to reverse.

It should be carefully analysed with all technical concepts in mind. Or else the downtrend may continue and you will lose all your hard earned money.

Look if previous pullback or swing high is broken. Only when the swing high of the downtrend is broken you can CONSIDER it for trading.

2. You should also know the fundamentals of a company if you are planning on holding it longer or just for investment.

3. Another important thing is you cannot buy low and sell higher when the entire market is in a downtrend or crash. You may want to consider short selling stocks or buying or selling futures and options.

So always consider the reality and manage your emotions while trading.

About Post Author

Resources & Links

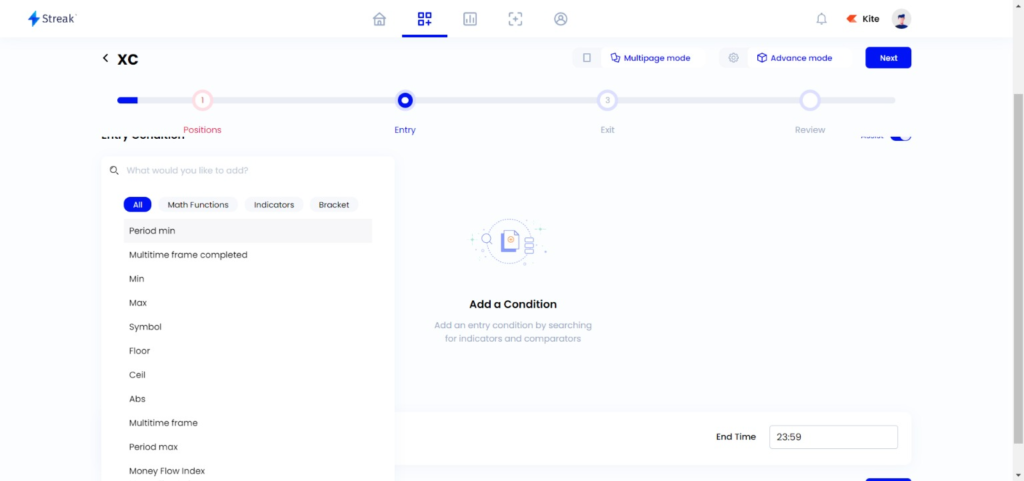

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.