The following are some stock market myths I’ve seen people believe when thinking about investing or trading in the stock market.

Common stock market myths debunked!

Stock trading is difficult

No. If there is a will, there is a way!

Stock trading is not difficult if you understand how the market operates. You must understand what drives stock and commodity prices. If you are unfamiliar with the fundamentals of the market, you should educate yourself before beginning to invest.

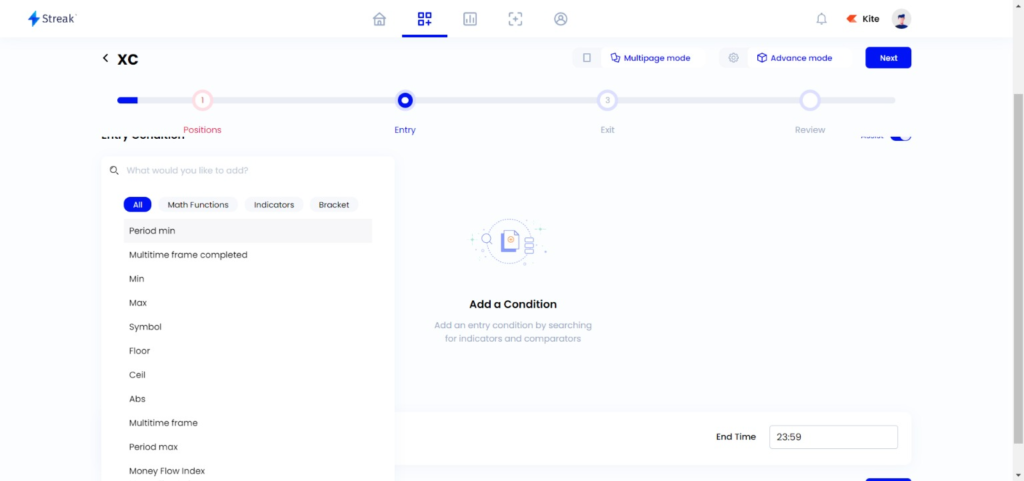

Trading is simple when you use technical analysis. Charts and graphs that depict past trends and patterns are used in technical analysis. Using historical data, these charts assist traders in forecasting future prices.

Trading is usually manageable if stop loss orders are used. A stop loss order is a type of limit order in which you specify a price below which you wish to sell your stock. When the share price reaches that level, you sell them automatically.

And it is not difficult if you have a plan. There are numerous strategies that work well for various types of traders.

Determine which strategy works best for you and stick to it.

You always need brokers or experts to help you

No.

You may require the assistance of a mentor at first. This does not imply making suggestions or providing calls. You only need to learn the fundamentals from them. However, once you understand the basic concepts, you can proceed on your own.

Difficult to open a trading account

No.

It is now very simple to open a trading account. Within a week, you can open a trading and demat account and begin trading. All you have to do is find a reputable broker and register with them. They will walk you through the steps. Simply upload the necessary documents, such as address proof, identification proof, and a cancelled bank check, and wait for approval.

Charges are too high

No.

Charges are extremely low, usually less than 1% of your trading capital. Think like a CEO if you want to be a successful full-time trader. If you have a business mindset, you will not be concerned about charges and small losses that are unavoidable in the market.

You can get rich quick in the stock market

No and it is a rare occurence.

It is extremely uncommon to become wealthy overnight in the stock market. You may get lucky once or twice, but if you want consistent returns while avoiding large losses, you must be patient. You can realistically earn 10% per month with less risk and on a consistent basis.

You need to trade with a lot of capital

Yes and maybe.

This is probably the biggest myth about day trading. Many traders think that they need a huge amount of money to get started. But actually, you can get started with little money. All you really need is some information and discipline. Once you have these two things, you can start making profits.

For example, you can begin forex trading with $10, which is 790 Rs. Or you can also purchase one share of a $5 stock. So capital is not a problem.

You need to trade a lot

No, best if avoided.

One of the biggest mistakes new traders make is that they try to trade too much. When you are starting out, you only want to trade a few times per week. As you gain experience and become more successful, you can increase your frequency.

You need to trade every single day

No, not necessarily.

When you first start out, you shouldn’t even consider trading every single day. You need to take weekends off, and only trade once or twice per week. Even experienced traders take breaks occasionally.

If you trade every single day, you will lose money. That is without a doubt. Trading every day is an excellent way to lose money. If you only trade once a week, you will have a much better chance of success than someone who trades every day.

You need to trade whenever the market opens

No, best if avoided.

Many new traders think that they need to trade as soon as the market opens. But the truth is that you don’t have to trade at the beginning of each session. In fact, you should wait until the market has had a chance to open up. Only then will you find the best opportunities.

Stock market is a scam

No and maybe.

Scams can be found everywhere. This is unavoidable.

The most common stock market scams involve convincing you to buy a stock so that they can later book profits and flee. Eg. Pump and dump scams, as well as providing false tips and calls.

A pump-and-dump scheme is a type of fraud in which a company artificially inflates the price of its own stock in order to profit from unwitting investors.A pump-and-dump scammer buys a stock at a low price and then sells it at a higher price before the public notices.When the public becomes aware of the scheme, the price falls and the scammer profits.

Another scam is called ponzi scheme. Ponzi schemes are named after Charles Ponzi, an Italian immigrant who ran a deceptive investment scheme in America in the 1920s. His strategy was to pay out returns to investors with money from newer recruits, giving him the appearance of legitimacy.

Insider trading occurs when a person trades a security based on information obtained outside of the normal course of business. Insider trading is a crime because it violates the trust between shareholders and management. Due to their inside knowledge, insider traders may sell their shares at inflated prices.

When businesses misrepresent the value of their products or services in order to attract customers, this is referred to as a fraudulent offering. Companies may claim that their product is far more valuable than it is. This is done to deceive investors into paying more than the product is truly worth.

There are scams everywhere. So don’t put your money in the hands of anyone.

Learn the fundamentals of the stock market, practise with the smallest amount possible, and then make your own decision.

You need to be a business or finance graduate to start investing or trading

Yes and No.

With some basic knowledge, you can begin investing. It will be simple and quick to understand how the market works if you have a background in finance or business. If not, you may require a guide, either in the form of books or mentors, to fully grasp the concept.

Trading is gambling

No.

The stock market is not gambling. In this market, you don’t have to trust anyone. Consider your options and act accordingly.

The stock market is a place where you can raise capital for your business from others and pay them a portion of your profits as a dividend.

The stock price will rise as more people begin to invest.

Meanwhile, investors and traders determine the stock’s value and buy and sell at a reasonable price.

Our ultimate focus is to forecast the company’s value, buy at the lowest possible price, and sell at the highest possible price.

All you have to do is learn and understand the fundamentals so you don’t have to rely on others.

Gambling is entirely based on chance. However, in the stock market, you can predict the price of a stock by analysing its fundamentals, technicals, and news updates, which will give you at least 10% returns every month if done correctly with money management.

Stocks that go up must come down or vice-versa

No. Not always.

Stocks that rise or fall in value may remain at the same level for an indefinite period of time. If the fundamentals of the company are not sound, it may be removed from the listings as well. In either case, you will be at a loss where profits are unlikely to be realised anytime soon.

Little knowledge is better than nothing

No. Not in stock market.

A little knowledge is always preferable to none. but not in the stock exchange. or in any other type of business. Before you enter the market, you must have a thorough understanding of it. Otherwise, you risk losing money for every minor blunder.

Experts recommendations are 100% accurate

No. Never.

No one is 100% correct, and this includes experts. If you are 50% accurate in your predictions, they may only be 70% accurate. We are all humans, and we cannot always predict the actions of other humans. They have more knowledge than you. But not always 100% accurate.

More diversified the portfolio, the better

No, not necessarily.

The best portfolio is one that is diverse. Stocks in a portfolio, however, should not be correlated. That is, if one stock falls, the corelated stock will also fall. This includes stocks from the same industry or sector. In that case, diversifying your portfolio is pointless. So, before investing, research the stocks.

My profit and loss is lesser than others

No. Never compare.

Do not compare your profit and loss figures to those of others. Because your capital and experience differ from those of others. So, before you make any assumptions when learning from a mentor or watching YouTube videos, consider their percentage return and years of experience.

Percentage gain is equal to percentage loss

No.

Because you may have to include charges for each trade, percentage gains are not equal to percentage losses. As a result, for every loss, you may have to gain slightly more than your loss.

I have lost all my capital during market crash

No.

Your money is not completely lost in the market. You can wait for the market to recover if you have done your homework and invested in the right stock. Because the market crash will not last indefinitely.

There have been numerous stock market crashes, and the market has always recovered from its lows. As a result, long-term investors and traders will be unaffected by the crash.

It will only have an impact on short-term investors or traders, as the market may take a long time to recover.

Stock market trading or investing always results in losses

No.

It is very much possible to make consistent profits from the market with proper analysis and money management.

Just buy low, sell high

No. Not easy.

You may need to determine which is the low and which is the high. This is the primary issue in the stock market. You can never predict the lows and highs with 100% accuracy.

You can even sell high and then buy low during a market crash. This is known as shorting.

Just follow Fii and insider trading

No.

Because the institutions are aware of the news ahead of time, they exit at the appropriate time. Those who blindly follow them risk incurring losses or missing out on opportunities.

Follow news daily

No.

You don’t have to watch the news every day to be a successful trader or investor. Because it is dependent on a variety of factors.

Investors may not need to read the news every day because they will need to analyse the company’s fundamentals before investing in it. If the company’s fundamentals are sound, it may be able to recover from short-term setbacks.

Traders, on the other hand, must keep an eye on the news depending on their trading style. Many other factors influence profitability, such as technicals, market sentiment, and so on. Sometimes the news has no impact.

Past performance equals future returns

No. Not necessarily.

The stock’s past performance is considered only for support and resistance, not for profitability.

Don’t set stop loss

No. Never.

Some people provide calls and request that you do not place a stop loss. It could be because they are profiteering from you or making calls without your knowledge. You will lose money in either case. Always use a stop loss when trading. You can always maintain a larger stop loss within the limits of your capital.

Stop losses aren’t always a bad thing. In fact, if done correctly, they can be quite useful. There are numerous reasons why a stop loss should be used. One of them is that you understand what is going on in the market and how much money you need to make. If you know the market is going down, you can set a stop loss at a level where you are willing to lose some money. But you don’t want to lose everything.

Stop losses are useless if you do not understand the market. Many people believe that they can simply place a stop loss order and let it ride. This, however, is not the case. Stop losses work best when you understand the market and where it is going. Stop losses cannot be used effectively if you do not understand the market’s direction.

Only young people can invest in stocks

No.

When it comes to stock investing, age is irrelevant. It does not imply that school students can invest without supervision. Anyone of a reasonable age who understands the risks involved and is able to manage the risk can invest or trade in stocks. Although the majority of traders are retired or working professionals.

Borrow money to buy stocks

Borrowing money from a third party or a broker is never a good idea. While profits increase when the market is in your favour, losses are also compounded.

Invest only in the best industries

No. Not always.

While investing only in the best industries is a good idea, you run the risk of missing out on companies that have the potential to grow and provide higher returns in the future.

Higher risk equals higher reward

No. Not always.

Higher risk does not always imply greater reward. Lower risk will result in consistent high returns.

High risk stocks are those that have been overvalued for a period of time. These stocks are considered risky because they could fall even further if the market continues to fall. These stocks, however, do not always provide higher returns than other stocks. Indeed, many high-risk stocks underperform the market.

Investing in penny stocks has the potential to make you wealthy overnight

No. Not always.

When penny stocks are carefully chosen, they provide good returns. However, the chances of becoming wealthy overnight by investing in penny stocks are one in a million.

Because of their high risk, penny stocks are not a good investment option. These stocks are frequently traded at low prices with little liquidity.

Furthermore, they are frequently thinly traded and may not trade at all.

Penny stocks are risky investments because of these factors and should only be considered if the investor is willing to take the risk.

Penny stocks are unregulated investments. They are not governed by federal laws. As a result, penny stocks are unregulated and can be bought and sold without restriction.

Penny stocks are vulnerable to fraud and manipulation due to a lack of regulation. Penny stock investors should be aware of this fact and conduct extensive research before making any purchases.

The best stocks are always those with a large market capitalization

May be.

Large-cap stocks are a better investment. Even those stocks could fall at any time. Diversifying your portfolio is always a better option.

Because of their size, large cap stocks have high volatility. When the market falls, they fall harder than small caps. Because they are smaller companies, small caps are less volatile.

Make sure to diversify your portfolio if you invest in large cap stocks. You should not put all of your eggs in one basket.

Only experts can profit in the market

No.

If all experts can profit from the market, why do they have to provide calls, take classes, or provide courses? Just for secondary income. Even market experts are not always correct. You have the same chance as they do. The only thing that separates us is market experience.

My experience with myths

When I first started trading, it was very confusing because I only knew the fundamentals of the stock market and nothing about trading on the short term.

So, in order to get to my goals faster, I signed up for a few free calling services and one paid service worth Rs 5000 back then.

I paid, and they began providing calls. All I had to do was buy and sell whenever a message came in.

This get rich quick scheme appears to be easy and simple, right?

NO.

I finally understood why people advise not to follow tips for service providers.

I didn’t realise that was the exact price at which I should enter when they asked me to enter. Instead, I came in a few minutes later. And recorded a loss.

When I asked what went wrong, they said I didn’t do it correctly but didn’t explain why.

These are the main issues with these calls.

1. We don’t understand the fundamentals of stock market trading.

2. No expert trader has a strategy that guarantees a 100 percent win rate. Our ability to manage our money and emotions is what allows us to be profitable.

So, it is always preferable that we learn the fundamentals and begin trading on our own.

About Post Author

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.