Trading Strategy Basics

While managing your emotions and the risks involved is essential for a successful trading career, learning your strategy is also important.

Trading strategy serves as the foundation for all other trading skills.

So learning how to develop your own trading strategy or simply selecting an existing strategy will be a critical step in your learning process.

After you’ve honed your trading strategy, you can focus on your emotions and money management abilities.

So, today, we’ll look at how to build your own trading strategy using the top gainer or loser intraday trading strategy example, which is both simple and profitable for beginners.

STOCK SELECTION

Stock selection is the process of deciding where and on which stock to enter a trade.

A stock selection method is the foundation of any trading strategy. You can select one based on your trading style.

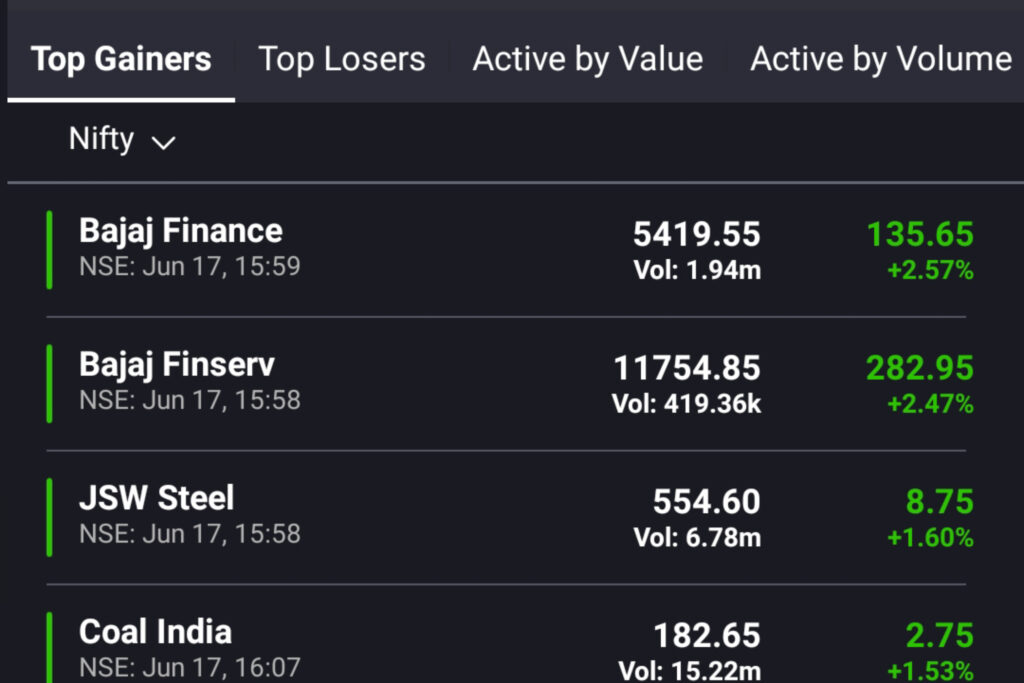

Stock selection methods include top gainers and losers, top volume, news-based, open interest, indicator signal, price action signal, and so on.

1. In this strategy, you can select the first three stocks from the money control site’s top gainers or top losers.

Choose based on market direction; for example, if the overall market direction is positive, select top gainers.

Instead of selecting the first stock, we can select the second or third stock, which will have some room to move upwards because the first stock has already reached its maximum potential by that time, or it may move a little higher later.

This strategy allows you to select the first three stocks in the top gainers or top losers based on market direction.

If the overall market trend is positive, we will select from the top gainers. If it’s negative, pick the top losers.

Instead of selecting the first stock, we can select the second or third stock so that these stocks have some room to rise because the first stock has already reached its maximum potential.

2. Generally, the second or third stocks will have some room to rise, so we’ll go with the second or third one.

3. I’ll also use larger time frames to filter the stocks among these three.

*In the video below, we’ll begin with Tech Mahindra as an example. We’ll investigate where we might have entered and exited.

(If you look at the money control website, you can quickly see the fundamental investing opportunities, such as strength, weakness, opportunity, threat, and so on.)

Also, technicalities. If you want to see all of the technicals, such as moving averages and RSI, you can quickly go through the section and select the stock.)

ENTRY CRITERIA

WHEN you enter the trade is the entry criteria.

There are numerous entry criteria available, which essentially tell you when to enter the trade. You can select it based on your personal preferences.

Breakouts and reversals are the two most common types of entry. Choose one that fits your personality.

4. Determine whether the stock is in an uptrend in a higher time frame. The closer it is to a range, the better. So you can buy the stock when it breaks out of the range.

The entry criteria in this strategy are range or previous level breakout. You can also use other entry criteria such as price action, indicator signals, and so on.

5. Beginners should trade between 9.45 a.m. and 10.30 a.m. We should be ready to take a trade in whatever stock you have chosen at 10 a.m.

6. Determine whether the volume is increasing. If so, select the stock.

In this example, if it is close to the previous level, prepare to enter the trade, and if it breaks this level, you enter the trade.

We can’t pinpoint the exact move because we don’t know where it will reverse or continue.

So, just to be safe, we’ll start right around the middle of the candle after entry.

So, as you can see, we start in the middle. Now, you can either use a normal candlestick or heikinashi, because you might be confused looking at the candlestick as a beginner.

7. Examine whether the heikinashi candle is green in colour, with a long body and wick pointing upward.

EXIT CRITERIA

Exit criteria define WHEN to exit a trade.

Prepare your exits for both profit and loss scenarios.

There are several types of exits, such as opposite signal of entry criteria, risk reward ratio, or trailing stop loss.

You can also modify your exit criteria based on your trading style.

8. In this case, you can book 30 points quickly. Alternatively, according to your risk-reward ratio. To lock in your profits, you can also use a trailing stop loss.

In this case, if it forms a range, a rectangle box, or whatever you want to call it, be ready to trade because it will provide a huge moment after the consolidation.

When a consolidation breaks out, it will give a quick huge moment like 5 or 10 points or depending on the time frame you’re trading, whether it goes down or up.

You can also see if it breaks above this the next day, or you can see how it reacts and understand the market from that movement.

You should always confirm the price with candlesticks because they show us the current price, price action, and what is going on in the market.

Take a look at the candlestick in this example. The day chart shows that it has broken its resistance, indicating that it will move in the positive direction for a few days, and we could have gotten it right here.

For trading strategies, see this example video on my YouTube channel.

This is the foundation of any trading strategy.

1. Stock selection method

2. Entry criteria

3. Criteria for exit (for profit & stop loss)

You can now combine all three fundamentals to create your own trading strategy.

I’ll be back soon with another trading-related post!

Where to learn about trading strategy for free?

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.