Trading Emotions

While a trading strategy is the main component of trading, our emotions play a significant role in maintaining consistent profitability. Our emotions not only influence our daily lives but also impact our trading decisions. These emotions are not limited to day trading alone; even swing and positional traders encounter emotional challenges, albeit to a lesser extent. In this blog post, let’s explore a list of trading emotions, share my experiences, and provide the necessary tips to manage them.

Fear

Fear was the initial emotion I experienced when I began trading, primarily due to my lack of knowledge about the subject.

However, as I started learning and gained understanding, it became a piece of cake. It’s no wonder why every expert advises you to manage your emotions!

The first few trades are often profitable, either due to holding them longer or experiencing ‘beginner’s luck.’ However, the real struggle begins afterward.

Without confidence in your strategy, managing fear becomes challenging, as it stems from a lack of knowledge.

This common emotion for beginners intensifies when holding a trade, especially when the price moves in the opposite direction, regardless of the trading style—be it day trading, swing, or positional. Fear persists without adequate knowledge.

Tips

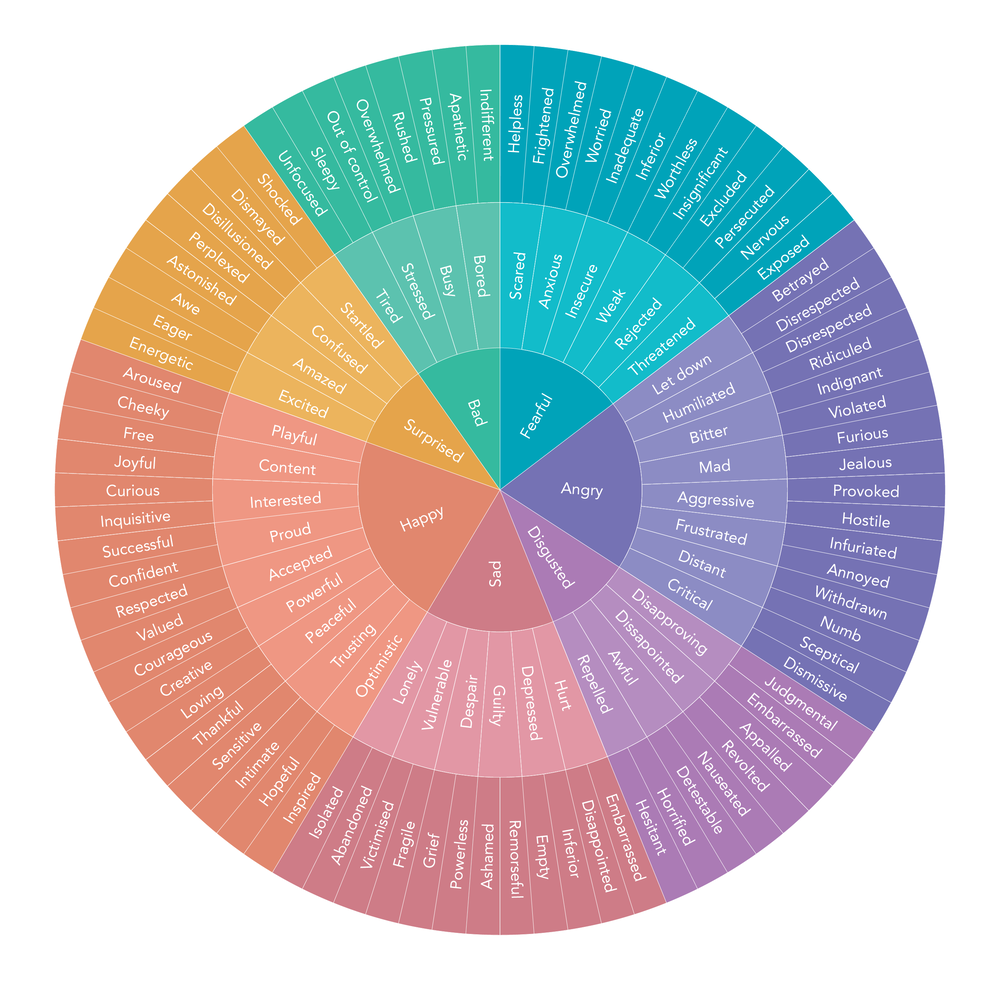

Identify the reasons for your fear by employing the 5 Whys technique. Understanding your core emotions is crucial in addressing and managing fear effectively.

If you are clueless, you can use this emotional wheel blog post from ‘Calm’.

At its core, fear often originates from some form of loss—whether it’s money, power, or control. In the realm of trading, fear may arise from the loss of money, control, ego, and similar factors.

To overcome fear in trading, I followed these effective tips:

- I acquired a solid understanding of basic trading concepts.

- I backtested my strategy, learned from mistakes, and gained confidence through adjustments.

- I used the 5 Whys technique to identify my underlying motivations.

- I embraced the reality of trading by creating affirmation boards to reinforce common facts:

- Losses are inevitable.

- Ride the trend.

- Distinguish between pullbacks and reversals.

- Recognize the significance of psychology and money management.

Greed

Greed often stems from the desire to earn more quickly or with minimal effort. To address it:

- Identify the reason behind wanting more money, whether for financial commitments, loans, status, specific goals, etc.

- Seek various solutions once you’ve identified the root cause.

- Learn about the most profitable trading styles and strategies.

- Recognize that emotional techniques alone may not reduce greed, but understanding market probabilities and average returns can help manage it effectively.

Tips

I addressed my greed by:

- Recognizing it was driven by a desire for luxury and monthly expenses.

- Increasing my capital slightly and reducing monthly expenses for better returns.

- Delaying luxury plans, understanding the need to sacrifice for a better alternative.

- Embracing the fact that achieving freedom in time, money, and avoiding office politics requires letting go of expectations for immediate results.

- Realizing that profitable traders typically earn 5-20% per month on average, not every month. Occasionally, higher returns can be achieved through options and futures trading.

These steps helped me avoid succumbing to greed.

Hope

Hope is a dangerous emotion in trading—it doesn’t work in your favor.

It might make you believe prices will reverse, trades will turn profitable, or losses will be recovered, but relying solely on hope is risky.

Understanding the logic of a trade is crucial; hope alone is insufficient.

The exception is when you grasp basic concepts, have confidence in your strategy, and adhere to trading rules. In such cases, hoping for long-term profitability is reasonable.

Tips:

The advice I followed, from a YouTube channel, emphasized that hope has no place in trading. I verified this through research and reflection.

The market is indifferent to my hopes, and relying on hope hurt my ego, especially during losses.

The key tip is to learn and understand the reality of trading.

Regret

Regret often arises when making a mistake without a clear understanding. Whether it’s a loss from a wrong move, poor money management, or emotional lapses, regret can occur even before closing a trade due to incorrect entry or invested capital.

Tips:

Personally, after learning and gaining confidence in my strategy, I no longer regret my decisions, even in the face of losses.

Consistently applying a backtested strategy with discipline and calculated risk management provides the confidence needed to navigate the market without regret.

Overconfidence

Overconfidence is a perilous emotion in trading, akin to hope but with positivity directed toward oneself.

After consecutive profits, there’s a tendency to feel exceptionally intelligent or talented in consistently making gains.

However, the market often serves a humbling lesson, reminding us of our fallibility through inevitable losses in the trading journey.

Tips:

To overcome overconfidence, acknowledge the reality that losses are inevitable, and profits do not grant control over the market every time.

Understanding these truths helps temper overconfidence and promotes a more realistic approach to trading.

Frustration

Frustration arises when we don’t achieve our desired outcome, a truth that extends beyond trading to life in general. In trading, it often manifests when expected profits are not realized.

Tips:

To overcome frustration:

- Understand the reality of trading and accept it.

- Maintain realistic expectations.

- Recognize that consistent returns every month are not guaranteed.

Following these tips helps manage frustration and promotes a more grounded approach to trading.

Impatience

Patience is indeed rooted in knowledge. Impatience can lead to overtrading and potential losses when desired results don’t materialize promptly.

Understanding the importance of patience and aligning expectations with the realities of trading is crucial for maintaining discipline and avoiding unnecessary risks.

Tips

To mitigate impatience, recognize that desired results may not align with your expected timeframe in trading. Timing is often unpredictable—sometimes too late, sometimes too soon.

In trading, the only elements under our control are our losses and emotional management.

Accepting this reality helps cultivate patience and resilience in navigating the uncertainties of the market.

Panic

Panic sets in when a substantial loss, whether due to personal actions or brokerages, leaves you devastated.

Tips

A valuable tip to avoid panic is to adhere strictly to your risk management rules, ensuring you don’t exceed a 10% loss of your capital per trade.

Additionally, practicing deep breathing exercises can help alleviate the symptoms of panic and promote a calmer mindset in challenging trading situations.

Excitement

Excitement, especially driven by the allure of potential profits, is a perilous emotion that can lure individuals into trading.

Tips:

- Understand and prioritize the importance of risk management, maintaining discipline in its application.

- Take breaks when overexcited to avoid impulsive decisions.

- Remind yourself that market control is not guaranteed, emphasizing the need for a balanced and rational approach to trading.

Disappointment

Disappointment often arises when experiencing losses without a clear understanding of the underlying strategy.

Tips:

To mitigate disappointment:

- Gain a thorough understanding of your strategy.

- Acknowledge the realities of trading.

- Follow your strategy with discipline.

By adhering to these principles, you can minimize the likelihood of disappointment associated with losses in trading.

Anxiety

Anxiety often arises from uncertainty about future outcomes in trading, such as whether a trade will be profitable or result in a loss.

Tips:

To address anxiety:

- Develop a trading strategy and plan, and adhere to it.

- Set stop loss and target levels after entry, allowing you to detach emotionally from the trade and reduce anxiety.

Implementing these strategies can help alleviate anxiety and promote a more structured and disciplined approach to trading.

FOMO

The Fear of Missing Out (FOMO) arises when the belief that a trade will yield excellent returns, prompts impulsive trading without a proper plan, often leading to overtrading.

Tips

Setting limits on the number of trades within specific time periods, such as 2 trades per day or 10 trades per month, can be effective in curbing overtrading, provided you adhere to these limits consistently.

Anger

Anger often arises when frustration with oneself or the market occurs, especially when feeling out of control in trades.

This sentiment can be fueled by unrealistic expectations, viewing the market as a kind of ‘genie’ that should deliver profits with every trade.

Tips

Recognize that making profits every time is not realistic; it’s neither your fault nor the market’s.

However, if you fail to learn the basics, practice, and follow the rules, then the responsibility lies with you.

Conclusion

These are the most common trading emotions, and these are the tips I followed to survive in the market.

Other less common emotions include euphoria, stubbornness, desperation, apathy, etc.

Whatever your emotions are, the only steps to overcome them are to journal your emotions, identify cognitive biases, and finally, meditate to manage them or resolve your practical problems.

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.