My trading journey 2024

Hello traders! It’s been a long time since I last wrote a blog post.

Life has been busy,

Cuz….

I focused on backtesting and paper trading strategies to improve my trading skills.

Transitioning to regular income from trading has been a roller coaster!!

Yeah… It’s stressful 🙄, but it’s also rewarding if you stick to it and stay focused… 🥹

Trading, like any career, comes with its own challenges.

But here’s the big question you should ask yourself: Which stress can you handle better?

The stress of a day job or the stress of trading?

This decision can guide you to choose the right path for your career.

Trading vs. Day Job

A day job provides a steady income, but it also comes with fixed hours, deadlines, and often monotonous tasks.

Trading, on the other hand, offers flexibility and freedom but comes with irregular income and emotional challenges.

If you’re thinking of choosing trading as a career, here’s what I suggest:

- Have at least three months of your monthly expenses saved up.

- Make sure you have a supportive family—both financially and emotionally.

Without these, trading can become much harder to manage.

Even with support, you may face criticism from people who don’t understand trading.

They might cheer when you make profits but call it a “failure” when you face even a small loss.

My Journey So Far

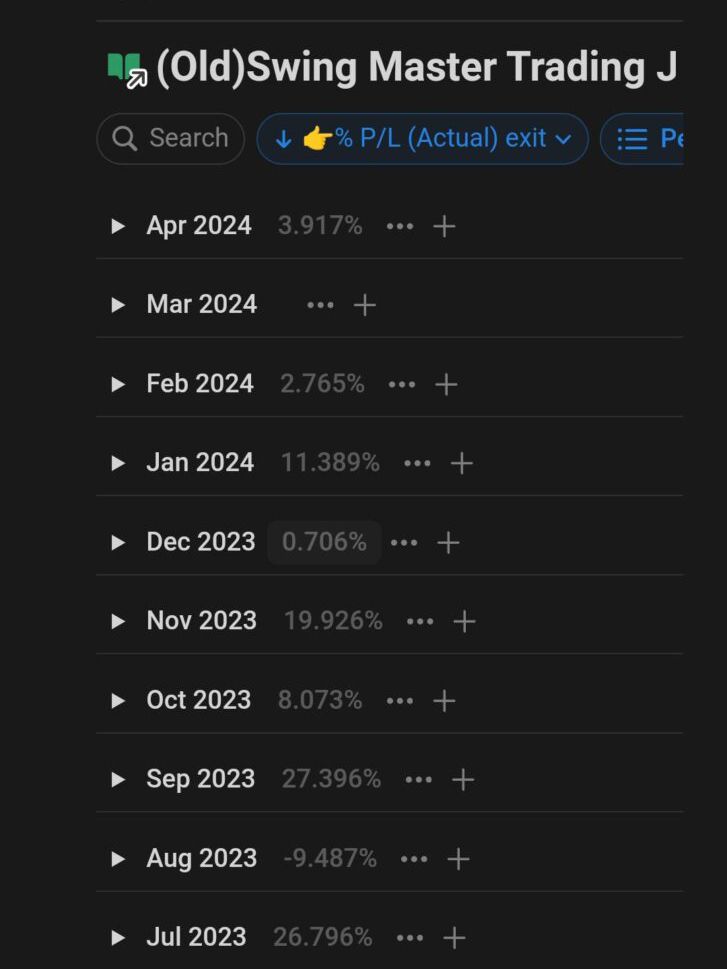

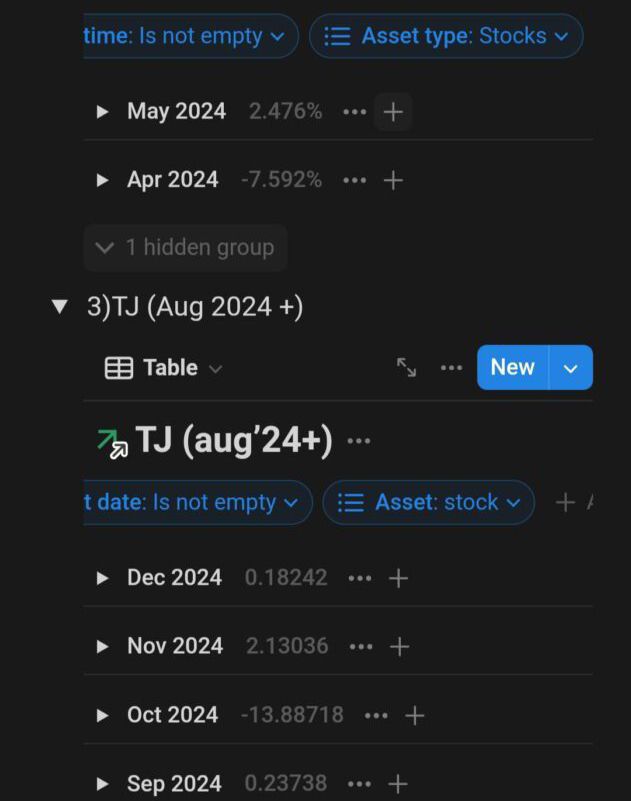

% PROFIT AND LOSS SO FAR :

This year has been full of lessons. I started with swing trading stocks, and

Since then ..

It has become my primary trading strategy.

Stocks have given me confidence and consistency, which I couldn’t find in other trading styles.

Commodity futures trading is always my second choice.

But…

I also experimented with options trading.

Initially, I had some profits, but then I faced losses that were twice as big as my profits.

That was a wake-up call…

So, I paused, tweaked my strategy, and started backtesting it again. Right now, I’m aiming to complete 100 paper trades to find a profitable options trading strategy.

So, swing trading stocks remains my primary focus because:

- Higher Winning Rate: It’s easier to predict compared to other styles.

- Confidence: The consistency helps me stay calm and focused.

The Ups and Downs of Trading

The year started with average profits from January to June.

Then came a bull run from June to October, which brought higher profits.

After that, the markets became choppy, and I hit more stop losses.

One big lesson I learned during the bull run was about overconfidence.

After several profitable months, it’s easy to think, “This will last forever.”

But trading doesn’t work like that. The market will surprise you, and you must be prepared for losses.

To succeed in trading, you need:

Patience: It takes time to learn the market and build strategies.

Resilience: The market is unpredictable, and you’ll face losses.

Discipline: Stick to your plan, even during tough times.

Is Trading the Right Career for You?

Trading isn’t for everyone. It’s not just about making money; it’s about managing uncertainty and emotional ups and downs.

Here’s what you need to ask yourself:

- Can I handle inconsistent income?

- Can I manage my expenses during slow months?

- Do I have the patience to learn and improve over time?

If you answered yes to these, then trading could be a good path for you.

However, remember that it’s not a get-rich-quick scheme. It requires hard work, constant learning, and emotional control.

Lessons from My Second Year

This is my second year of earning a regular income from trading.

It’s not a fixed income, but it’s steady enough to manage my needs. With every passing month,

I’m learning more about the market and how to adapt to its changes.

Here are some key takeaways from my journey:

- Always have a backup plan. Save enough to cover at least three months of expenses.

- Don’t get overconfident after a few good months. The market can change at any time.

- Keep improving your strategies. Backtesting and paper trading are essential for long-term success.

Final Thoughts

Trading is not an easy career, but it can be incredibly rewarding if you’re willing to put in the effort.

This year has been a mix of profits, losses, and valuable lessons…

I’m still working on my options strategy while sticking to swing trading stocks as my main focus.

As I move forward, I’m optimistic about what the future holds. The journey isn’t over, and I’m excited to see how it unfolds.

If you’re on your trading journey, I encourage you to stay patient, keep learning, and never stop improving.

Remember, success in trading doesn’t happen overnight—it’s a marathon, not a sprint.

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.