Expiry day trading involves trading on the day an option contract expires. Index options are commonly traded on expiry day.

Since expiries occur weekly or monthly, traders will have frequent opportunities to participate.

I prefer trading BankNifty for expiry trades because of its higher volatility, significant moves on trending days, and a smaller lot size of only 15.

Backtesting

As I couldn’t access historical premium prices for options, it was challenging to develop a strategy to fit my style and backtest premiums at specific times.

Therefore, I conducted live market testing for a period. With minimal risk and the ability to start trading with a small capital, I found no necessity for extended paper trading.

Strategy

My strategy was very simple. On expiry days after 2:30 pm, I selected out-of-the-money (OTM) prices, typically 2 points away from the at-the-money (ATM) price, in the direction of the breakout.

I then chose the opposite side also, to execute a long straddle. Sometimes, if I was highly confident about the direction, I opted for a naked call or put option instead of a long straddle. While naked calls can give higher returns if done correctly, they are the riskiest among all strategies.

The logic

This strategy is often referred to as the ‘zero or hero‘ strategy because on expiry days, especially after a certain time, the initial investment required is minimal due to the time decay nature of options.

When the spot price breaks out and generates a trending move, the options contract purchased at a low price has no option but to increase in value according to the movement. This is where profits are realized.

It’s termed ‘zero or hero’ because it signifies the potential for either complete loss or huge returns.

However, it’s important to recognize that it’s not a guaranteed ‘zero to hero’ transformation every time, as trading always involves probabilities.

Caution

While this strategy doesn’t work every time, it’s important to avoid getting stuck in a sideways market, especially with the long straddle.

If the market doesn’t make a big move, you could lose the money you invested in both options. Though it’s less risky, you still need to be careful.

With naked calls, even small market moves can make you money, but it’s the riskiest strategy. If you’re wrong, you could lose everything.

At first, I liked using long straddles, but if the market breaks out strongly in one direction, I switch to naked options, as the investment is also minimal.

First trade

The first attempt didn’t go well because I rushed and chose the wrong premiums, leading to losses of 74% and 98%, totaling a 172% loss.

It was lesser than 1% of my total trading capital, so I wasn’t too concerned. With a long straddle, both options are supposed to be at the same strike price, like 4600 CE.

I made the mistake of selecting the wrong ones and exiting at the wrong time, causing the losses.

2nd trade

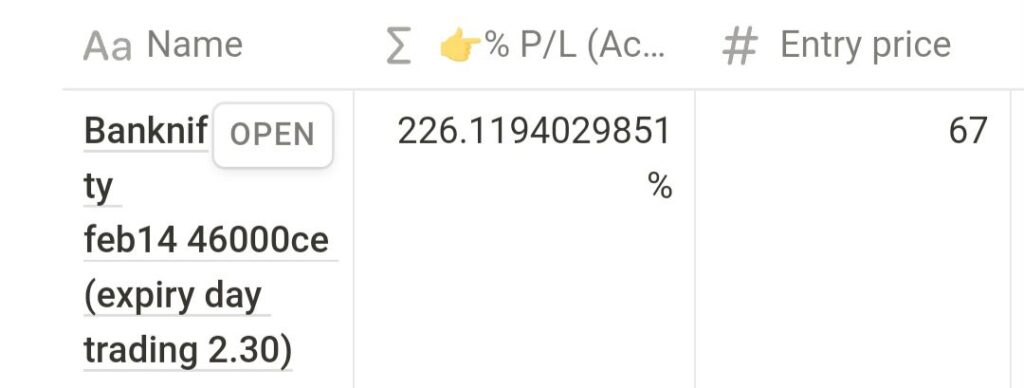

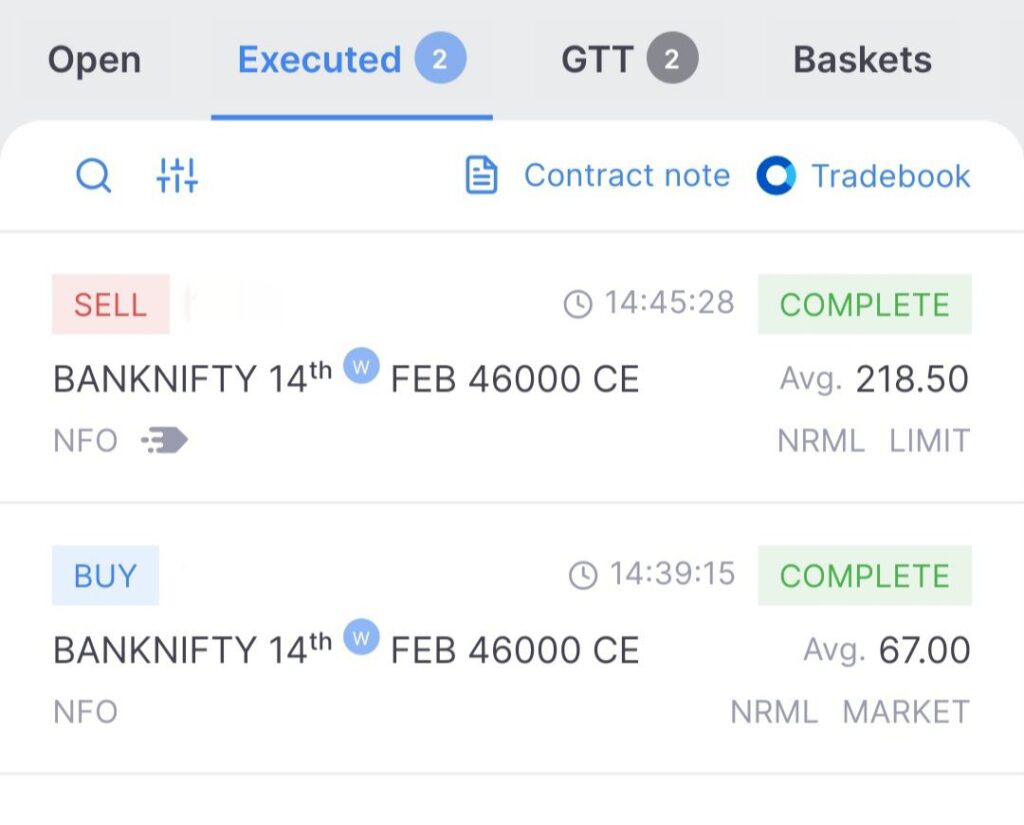

This was a good trade with over 200% profits on Valentine’s Day.

What I did here was nothing but a simple resistance breakout.

Since I am a consolidation breakout trader, my eyes naturally look out for more touch points in a resistance.

When I find one, it’s a treat for me.

This is the only high-probability setup I use in trading.

Here, I traded in BankNifty, and it gave a breakout after three touch points, and that’s when I entered. I trailed my stop losses for the exit.

Takeaway

Overall, both of my expiry trades together gave a 50% return, but the capital used in each trade was different.

So, comparing the returns of both trades is not accurate.

However, what’s important is that the losses were small, and the profits were significant, resulting in a total profit. And that’s the most important rule of money management.

Cut your losses and let your profits run.

This is the only way to be profitable, regardless of your strategy.

Also, you can check this out in a video :

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.

Simply wish to say your article is as amazing The clearness in your post is just nice and i could assume youre an expert on this subject Well with your permission let me to grab your feed to keep updated with forthcoming post Thanks a million and please carry on the gratifying work.