After creating your trading strategy, you need to validate it. You can either do demo trading and use it as a backtest report, or run a back test software, find the results and then try demo trading.

And you can also do paper trading for a 5-10 trades to see if it suits your style, and then do backtesting, then again paper trade for 100 trades. Just repeat the cycle, till you find your profitable strategy and gain confidence.

Either which ways, paper trading is the second most important step in trading.

You should not spend more time on paper trading as there are also other factors involved in live trading.

So, What is Demo Trading?

Simply put, paper trading is the practice of trading with imaginary money. Paper trading basically involves trading on a paper, notebook, or just a digital diary, rather than using real money.

Why do we need to practice trading with fake money?

Pros

It is better for beginners to start with demo trading, collect enough data and then enter the live market with confidence. It gives you a sense of market understanding so that you don’t have to use it on your real money.

It gives you the data of your trades and win rate of your strategy.

Cons

The cons is it cuts off the emotions attached to the live trading, which is the major part of your trading success.

It doesn’t consider the entire market conditions.

It doesn’t consider trading on the news and important events.

It doesn’t include slippage, spreads and commissions.

Types of Paper Trading

There are 2 ways to do your Paper trading.

Online

Online methods include demo trading on

Digital notebooks,

Dedicated apps and

Dedicated websites.

Offline

Offline demo trading methods include trading on a

Paper,

Notebook,

Diary,

Or pretty much anything.

How to Paper Trade?

Online

To start demo trading online, find out sites that allow you to do so. You can find free, paid or freemium sites and apps online.

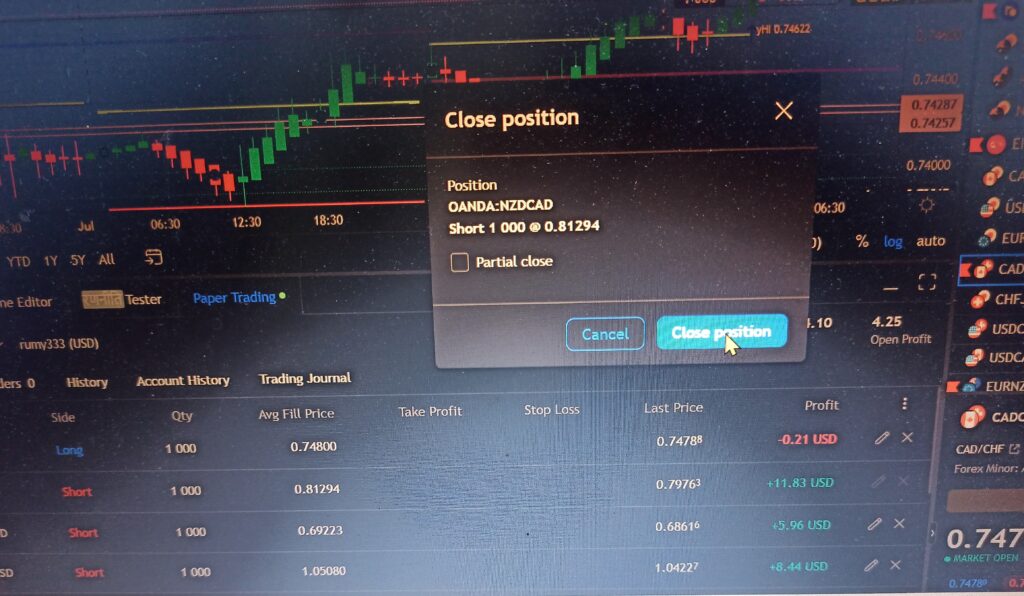

There are tons of tools out there, but the most basic and the easiest site for begginers is just using paper trading on Tradingview.

Just open an account on your desired virtual trading platform.

Once approved, the platform gives you some amount of virtual money, which you can use to trade.

It records your recent trades in the history section.

It gives you a sense of confidence in the market.

Online paper trading is always better than offline trading.

Offline

Offline demo trading is entirely up to you. You can decide on your initial balance, type of assets and place to record your entry and exits.

You can record it on your notebook, paper, diary etc.

You can paper trade on equities, futures, options, cryptocurrencies, forex and pretty much everything without any limitations that online paper trading platforms have.

Photos of demo trading

You can paper trade it on a notebook or in tradingview like this..

Where to demo trade?

Here are the list of websites to paper trade the US market, forex and cryptocurrencies :

| Sites/Apps | US market | Forex | Cryptocurrency | Derivatives |

| Thinkorswim | Yes | Yes | – | Yes |

| Webull | Yes | – | Yes | Yes |

| Interactive Brokers | Yes | Yes | – | Yes |

| Tradestation | Yes | – | Yes | Yes |

Sites to paper trade commodities :

You can use forex.com or tradingview to trade commodities.

Sites to paper trade Indian Stock Markets :

Tradingview

Frontpage

Moneybhai

Dalal street

ICICI direct etc.

Lessons learnt

I have paper traded at the beginning of my trading journey.

What I have learnt from paper trading is that people say ‘it doesn’t involve emotions, don’t try it”.

I agree. It doesn’t involve all your emotions. But you should definitely try it, especially if you are a beginner.

And also, if you are a perfectionist like me, you would want to win all your trades, even on a paper trade! So it does help you in identifying few of your emotions.

The most common emotions you cannot experience in paper trading are frustration after losing money and fear of losing money.

Where can I learn demo trading for free?

You can use tradingview to paper trade or demo trade any asset for free. Check out the video below to see it in action.

Common FAQs

Where can I do Paper Trading for free?

There are tons of sites and apps out there, if you are considering the online version. You can also switch between online and offline version.

Sites like tradingview, trade ideas, webull, trade station and thinkorswim offers free paper trading in the US market.

You can use apps like front page to paper trade in Indian markets.

Does paper trading affect the market?

No. Any trade taken on virtual trading platforms will not affect the market or your real money.

Can you paper trade options in tradingview?

No. You cannot trade options in tradinview. You can use sites like eoptions, interactive brokers, TD Ameritrade to trade US stocks and options. You can use frontpage app for Paper trade Indian stocks and options.

Can you make money paper trading?

Yes. Some sites like webull, moomoo, benzinga has competitions on regular basis and gives away prizes for winners.

Can you do paper trading in Zerodha?

No.

Can you short on paper trading?

Yes. Almost all the platforms allow shorting in the market.

Is paper trading delayed?

No. Paper trading is not delyed.

How long should I paper trade?

1-6 months for a brand new trader. Not more than that because there are few other factors that are involved only in the live market.

What are some of the resources to learn about paper trading?

Check these resources to learn more..

Takeaways

- Paper trading is just trading in a simulated environment.

- It can be done on online (eg. Tradingview) and offline (eg. Notebook).

- Paper trading is a must try for beginners atleast for a month. But do not waste your time for more than 6 months.

- When you shift from paper trading to live trading, the main thing to keep in check is your emotions.

That’s it for step 3. Meet you soon with step 4 and a detailed post.

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.

Pingback: My 10-STEP trading process for complete beginners !! - ART OF HACKS