So what is the best time to trade? The best time to trade depends on many factors.

Experience

The first factor is your level of experience. If you are a beginner, you should avoid trading when the market is open. Because it is extremely volatile.

It will move 50 points higher in one candle and then drop 100 points lower in the next candle. Not always the next candle. So, always set a STOP LOSS. As a result, beginners should avoid trading at market open.

With experience, you know when to enter a trade, when to exit, how much movement you can tolerate, and so on. You can trade at the market opening time if you are well informed, knowledgeable, and practised in all types of market conditions.

This is mostly the first and last hour.

Type of trading

This time and volatility considerations are primarily for intraday trading. There is no issue with timing if you plan on swing trading. You can do it whenever you want.

However, for intraday trading and if you are a beginner, you can only trade during the second hour; after the third hour, volatility will be very low and movements will be very slow. Profitability is difficult to see.

If you are an options trader, you should strictly avoid these times because volatility will be very low at that time of day and premium decay will be faster.

Type of Market

Forex

The 24/7 forex market is divided into 3 sessions. Asian, London and New york session.

The entire Asian session will be usually very slow and the London or New York session will be volatile during the market opening time.

The remainder of the time during the two sessions will be moderate. However, the Asian session will be extremely slow. In forex market, this is the case. As a result, the best time to trade will change depending on the market.

Commodity market

If you trade commodities in the Indian market, the evening session will be very active because most working professionals in India trade in the evening session. So, depending on the market, the best time to trade will change.

As a result, you should always trade when the market is active and volatile. If it is very huge, you will be unable to handle it; if it is moderate, it is suitable for both beginners and experienced users.

Backtest it

You can determine the best time according to your preferences by directly backtesting it or by using simple indicators and settings.

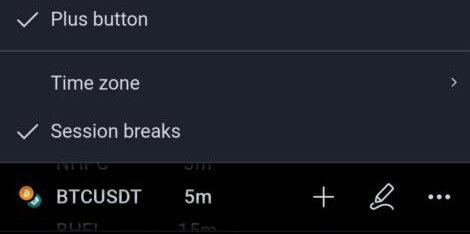

Session breaks

This session break option is available in the gear icon in the tradingview chart. When you turn it on, each day is separated by vertical lines. This is the basic setting required to track your best trading time. It will be simple for you to keep track of opening and closing times.

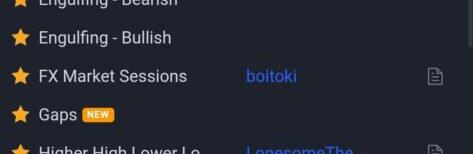

Forex time breaks

If you want forex time breaks, tradingview has a plethora of indicators. This indicator will divide the chart into three forex sessions based on your time zone. So you can see how the market reacts in each session with this.

Hourly seperator indicator

If you want to test the time of the stock manually and at random, you can use the hourly separator indicator, which divides the chart based on our settings.

For example, if you want to track trades at 1:30 a.m., change the interval in the settings to 1.30, and it will display a vertical line at that time, allowing you to track all of your trades during that time period. As a result, you will be able to better predict when a particular market or stock will react.

Finally, when back testing, keep in mind that different stocks may react differently at different time intervals or in response to different external forces such as results, news, etc. For example, in the Indian market, movement will be slow between 11 a.m. and 1 p.m. When the European market opens here after 1 p.m., there will be a strong price movement in one direction.

Resources & Links

Tradingview – Charting Platform

Zerodha – Trading brokerage platform (India)

Disclaimer

Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consider seeking professional advice before making any investment decisions. The information provided on this platform about digital entrepreneurship is based on the author’s experiences and industry knowledge. It should not be considered as financial, legal, or business advice. Please consult with experts in these fields before making business decisions. This blog may contain affiliate links, and we may earn a commission if you make a purchase through these links. Your support is appreciated.